It was a very mixed month for world equity markets, with net monthly changes ranging from +11.7% (Russia), +4.6% (China), +3.2% (Brazil), +2.1% (Germany),+1.6% (Japan), +1.5% (Hong Kong), +0.04% (USA), -0.6% (South Africa), -2.6% (India), to -3.3% (Australia).

Lets take our regular look at ten of the world equity markets.

USA - Dow

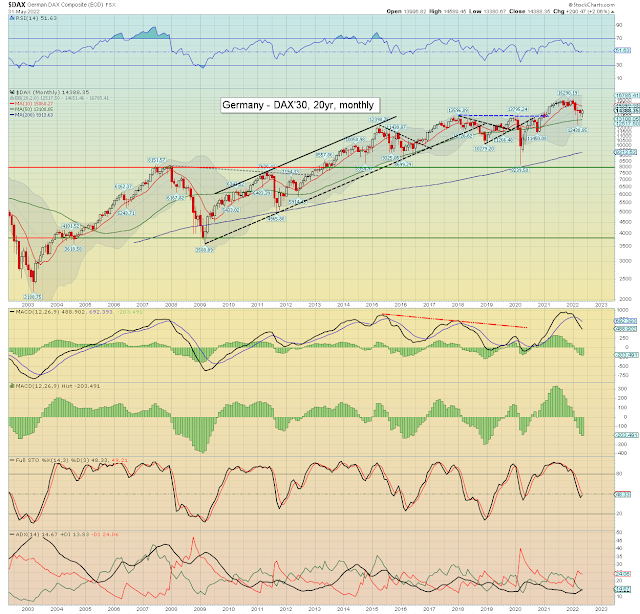

Germany – DAX

Japan – Nikkei

Brazil – Bovespa

Russia - RTSI

India – SENSEX

China – Shanghai comp'

South Africa – Dow

Hong Kong – Hang Seng

Australia – AORD

–

Summary

Seven world equity markets were net higher for May, with three net lower.

Russia and China lead the way up, whilst South Africa, India, and Australia struggled.

Eight markets are trading under their respective monthly 10MA, and are to be seen as m/t bearish. The two exceptions being Brazil and South Africa.

-

Looking ahead

The schedule is light, the highlight being the latest inflation data.

Earnings:

M - COUP

T - MOMO, CBRL, SJM, CASY

W - LOVE, CPB, FIVE

T - NIO, SIG, FCEL, BILI, DOCU, MTN, SFIX,

F -

-

Econ-data:

M -

T - Intl' trade, consumer credit

W - Wholesale invent', EIA Pet'

T - Weekly jobs

F - CPI, consumer sent', US T-budget

--

Final note

If you're not hearing the sound of giant chess pieces being moved across the planetary board, you're simply not paying attention. We've an entertaining summer ahead, but things will get 'real interesting' this fall.

I will hope that most of you won't be like the mainstream hacks, and utter '... who could have seen this coming?'. It is coming, and the clock IS ticking.

For details >>> https://www.tradingsunset.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.