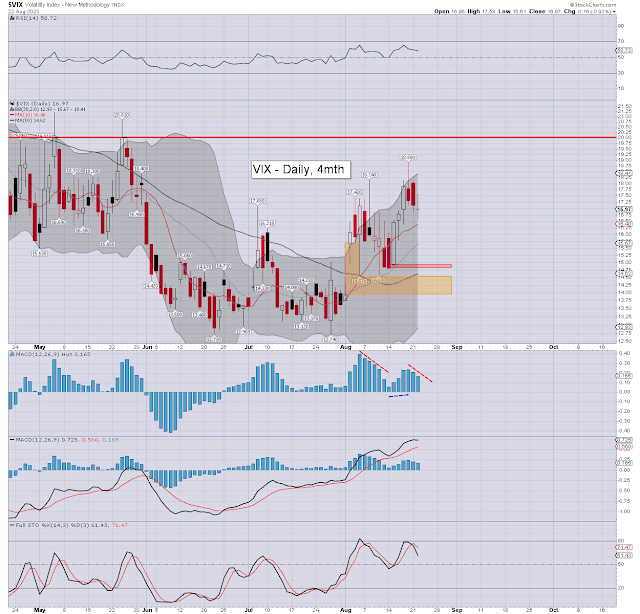

It was a mixed week for US equity indexes, with net weekly changes ranging from +2.3% (Nasdaq comp'), +0.8% (SPX), +0.1% (NYSE comp'), -0.3% (R2K), -0.4% (Dow), to 0.5% (Trans).

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

Three US equity indexes settled net higher for the week, with three net lower.

The Nasdaq was very significantly higher, whilst the Transports was moderately lower.

Weekly price momentum is negative in the SPX and Nasdaq, the other indexes could be expected to follow into September.

–

Looking ahead

Earnings:

M - NAT, BZUN, HEI

T - NIO, BBY, PDD, BIG, SJM, HPE, HPQ, BOX, AMBA, PVH

W - CRWD, CRM, OKTA, CHWY, VEEV, FIVE

T - DG, PSNY, UBS, CPB, MOMO, AVGO, LULU, DELL, VMW, NTNX, PD

F -

-

Econ-data/events

M -

T - Case-Shiller HPI, JOLTS, consumer confidence

W - ADP jobs, Q2 GDP (print'2), Pending home sales, EIA Pet'

T - Weekly jobs, personal income/outlays, PCE

F - Monthly jobs, ISM manu', construction

*As Thursday is end month, I'd expect more dynamic price action on higher vol'.

**As Friday is the lead into the Labor day holiday, once the BLS jobs data is out of the way, I'd expect subdued price action on very light vol'.

-

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! For details and the latest

offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 4.20pm EST on

Monday.