It was a mixed month for world equity markets, with net monthly changes ranging from -9.5% (Russia), -9.4% (Germany), -4.6% (USA), -1.9% (South Africa), -0.9% (Japan), -0.7% (Brazil), +0.2% (China), +2.1% (Australia), +2.8% (Hong Kong), to +4.1% (India).

Lets take our regular look at ten of the world equity markets.

USA - Dow

The mighty Dow fell for a second consecutive month, settling -1280pts (4.6%) to 26501. Note the 10MA at 26026, which is only another 1.9% lower. Monthly momentum has stalled just below the key zero threshold, and leans problematic... at least for early November.

Germany – DAX

German equities declined for a second month, settling -1204pts (9.4%) to 11556, back under the 10MA. Momentum has rolled over, and settled fractionally negative.

Japan – Nikkei

Japanese equities settled -207pts (0.9%) to 22977, although that still made for a third settlement above the monthly 10MA.

Brazil – Bovespa

The Brazilian market cooled for a third consecutive month, settling -650pts (0.7%) to 93952, back under the 10MA.

Russia - RTSI

A second month of cooling for Russian equities, -111pts (9.5%) to 1066. I would note key price threshold of the 1200s. Lower bollinger support around 1000.

India – SENSEX

Indian equities saw a high of 41048, settling +1546pts (4.1%) to 39614. Monthly momentum is set to turn positive in November.

China – Shanghai comp'

Chinese equities settled +6pts (0.2%) to 3224. The October candle settled black, which is extremely rare, and leans s/t bearish. China bulls have downside buffer to around 3K, where the 10MA is lurking.

South Africa – Dow

The South African market fell for a third month, settling -30pts (1.9%) to 1598, just 4pts above the monthly 10MA.

Hong Kong – Hang Seng

Hong Kong equities settled +648pts (2.8%) to 24107, having not managed a settlement above the 10MA since Dec'2019.

Australia – AORD

Australian equities settled +123pts (2.1%) to 6133. Whilst this was a settlement above the monthly 10MA, the October candle is spiky, and threatens lower lows in November.

–

Summary

Six markets settled net higher for October, whilst four settled net lower.

Russia and Germany saw severe declines, whilst Australia and India managed very significant gains.

The USA, Japan, India, China, South Africa, and Australia, settled above their respective 10MA, whilst Germany, Brazil, Russia, and Hong Kong, settled below their respective 10MA.

-

Looking ahead

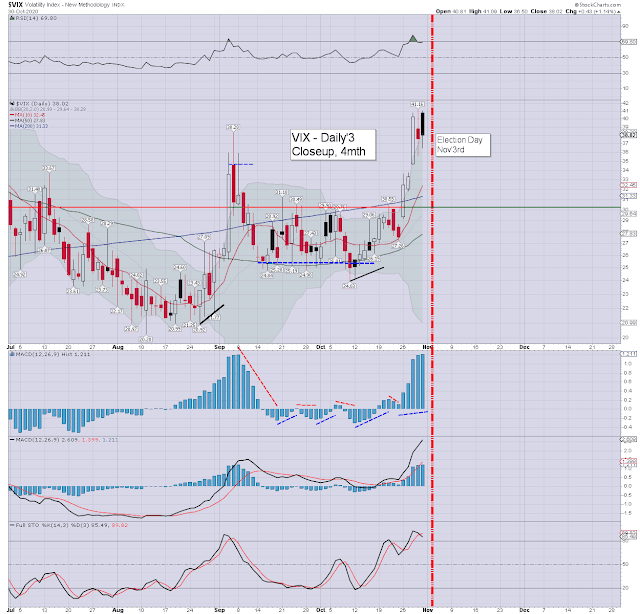

An exceptionally busy week is ahead, not least with further earnings, an FOMC, and of course... the US election.

Earnings:

M - CLX, LL, MPC, WM, EL, ON, AMCX, PYPL, SWKS, SEDG, ANET, AMC, CRUS

T - W, HUM, BHC, RACE, CTLT, AGCO, GWPH, BTG, CC

W - WEN, HLT, QCOM, ZNGA, MELI, MTCH, MRO, PAYC, ACAD

T - BABA, GOLD, GM, AZN, REGN, AMRN, BMY, CRON, PZZA, TEVA, SQ, ROKU, PTON, NET, SPCE, TTD, DBX, AYX, UBER

F - CVS, ENB, VIAC, MAR

-

Econ-data:

M - PMI/ISM manu', construction

T - Factory orders, vehicle sales

W - ADP jobs, PMI/ISM serv', EIA Pet'

T - Weekly jobs, Productivity/costs,

*FOMC announcement 2pm. Press conf' 2.30pm. Its possible, if not probable that Print Central will announce 'yield curve controls'.

F - Monthly jobs, wholesale invent', consumer credit.

--

|

| Halloween 2020 |

Final note

October sure wasn't pretty for the US, or many other world equity markets. November threatens lower lows, as the mainstream are concerned about Corona case (not death) numbers, and a possible economic 'double dip'. It should be clear, further fiscal stimulus can be expected from national governments across the world, largely funded by even more QE from the various central banks.

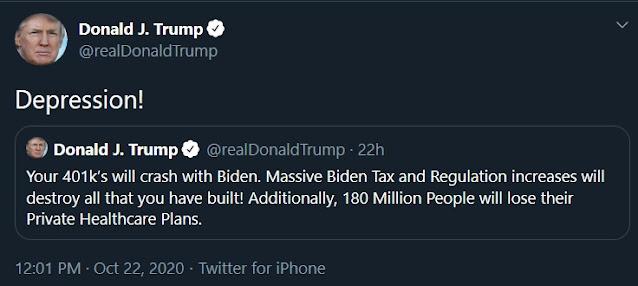

The election is just a few days away. Many are expecting Biden to win. Some are expecting a contested election. Then there are those who expect Trump to win a second term.

I could understand if many of you, consider the following 'crazy talk'...

|

The above is a sincere 'best guess'. Despite what some of you might think, I'm actually a political atheist. Sure, if I 'had to choose' between the two, I'd vote to elect Trump.

Whilst I called 2016 correctly, I don't have a time machine, and I'm more than curious to see how this plays out. I guess I'll be awake until 7am GMT this November 4th, and maybe a few hours beyond that. There is nothing quite like the drama of an election night!

I'll be frank and say, more than anything, I want Trump to win, if only to annoy the left leaning marxists/communists, who would like nothing more than for America to be burnt to the ground.

Whomever you want to win, what can be said with certainty... life in the twilight zone will continue to become ever more twisted and bizarre.

|

| A rare Halloween full moon |

If you value my work, and want more of the same, then subscribe to my intraday service.

For

details, and the latest offers: https://www.tradingsunset.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.