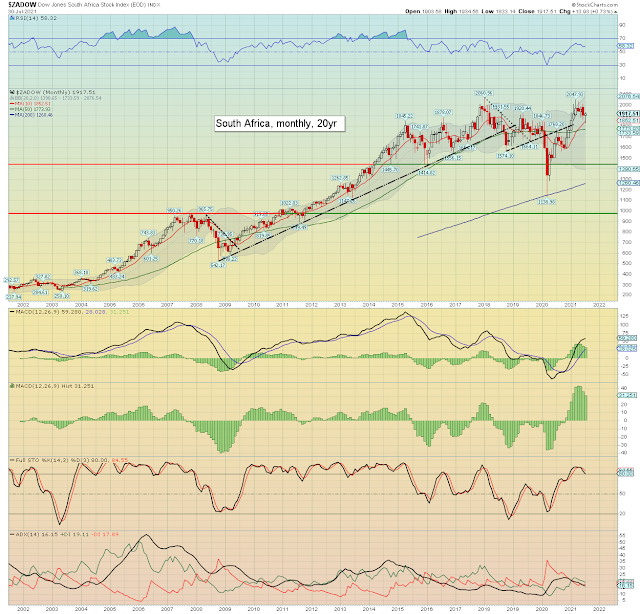

It was a very mixed month for world equity markets, with net monthly changes ranging from +1.2% (USA-Dow), +1.0% (Australia), +0.7% (South Africa), +0.2% (India), +0.1% (Germany), -1.7% (Russia), -3.9% (Brazil), -5.2% (Japan), -5.4% (China), to -10.1% (Hong Kong).

Lets take our regular look at ten of the world equity markets.

USA - Dow

Germany – DAX

Japan – Nikkei

Brazil – Bovespa

Russia - RTSI

India – SENSEX

China – Shanghai comp'

South Africa – Dow

Hong Kong – Hang Seng

Australia – AORD

–

Summary

Five world equity markets were net higher for July, with five net lower.

The USA was strongest, whilst Hong Kong was severely lower.

The USA, German, Indian, and Australian markets broke new historic highs.

The USA, German, Brazilian, Russian, Indian, South African, and Australian markets are holding above their respective monthly 10MA, whilst the Japanese, Chinese, and Hong Kong markets are not.

-

Looking ahead

A very busy week is ahead, with another truck load of earnings, and a wheel barrow of econ-data.

Earnings:

M - ON, RACE, TTWO, FANG, NXPI, RIG, MOS, SEDG

T - BABA, CRSR, BP, COP, UAA, LLY, CLX, NKLA, DISCA, ATVI, OXY, AYX, DVN, LYFT

W - GM, CVX, KHC, RCL, MPC, ROKU, EA, UBER, ETSY, FSLY, MRO, WDC, WYNN

T - MRNA, PENN, VIAC, W, YETI, REGN, SPCE, NET, BYND, Z

F - DKNG, CGC, NCLH, CRON,

-

Econ-data:

M - PMI/ISM manu', construction

T - Factory orders, vehicle sales

W - ADP jobs, PMI/ISM serv', EIA Pet'

T - Weekly jobs, intl' trade

F - Monthly jobs, wholesale invent', consumer credit (3pm)

--

|

| ... and once more, night must fall. |

Final note

It was indeed a very mixed month for world equity markets. Whilst the US market broke a new historic high, on the other side of the planet, things weren't going so well in communist China or their 'Special Administrative Region' of Hong Kong.

Neither are things going so well in neighbouring Japan, holding the Olympics, with Tokyo officially in a 'state of emergency'. Incredible.

With the Dow, SPX, Nasdaq comp', and NYSE comp' breaking new historic highs in July, the crash

calling lunatics would do well to remain in their basements until at least Labor day.

If you value my work, subscribe to my intraday service.

For

details, and the latest offers: https://www.tradingsunset.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.