It was a mixed week for US equity indexes, with net weekly changes ranging from +1.2% (Transports), +0.5% (NYSE comp'), +0.2% (Nasdaq comp'), -0.7% (Dow), to -0.8% (SPX).

Lets take our regular look at five of the main US indexes

sp'500

Nasdaq comp'

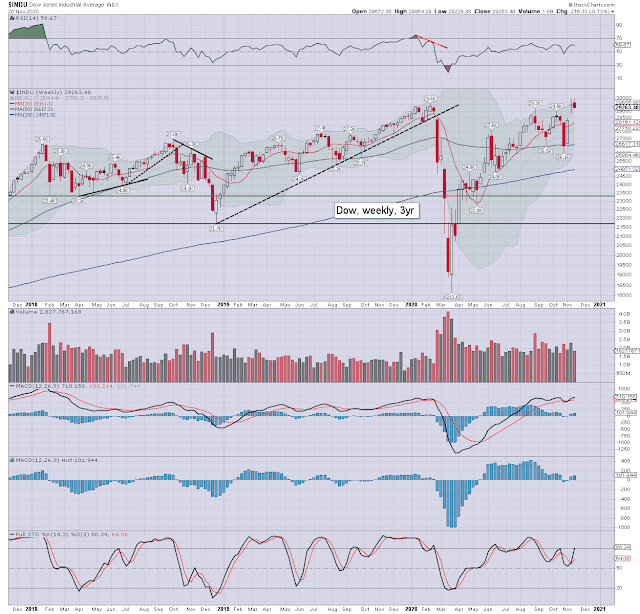

Dow

NYSE comp'

Trans

–

Summary

Three indexes were net higher for the week, with two net lower.

The Transports was significantly higher, whilst the SPX was the laggard.

The Dow and Transports broke new historic highs.

–

Looking ahead

It will be a short 3.5 day trading week, with Thursday closed, and an early Friday closing of 1pm.

Earnings:

M - BZUN, A, URBN, NTNX, AMBA, CBT

T - BBY, DKS, DLTR, MDT, ANF, HRL, BURL, ADI, ADSK, JWN, DELL, GPS, HPQ, AEO

W - DE

T - -

F - -

-

Econ-data/events

M - Chicago Fed' Nat' act' index. PMI Manu' & Serv'

T - Case-Shiller HPI, Consumer con'

W - Weekly jobs, Q3 GDP (print 2), Durable goods orders, Intl' trade, new home sales, consumer sent', pers' income/outlays.

T - *CLOSED*

F - *early closing 1pm EST*

-

Final note

With a pair of new historic highs, it was just another week for the equity bulls. Considering renewed lockdowns, and the realisation that Q1 2021 might see an economic contraction, the market is holding together very well,

There is the matter of the election of course. Whichever side of that political freakshow you might belong to, the market is clearly hoping for gridlock. I will merely add that Trump continues to be 'lightly dismissed', and for now... he IS the President of the United States of America.

In any case, further fiscal stimulus is coming at some point, and that is all that many care about these days. After all, higher equity prices mean everything is just fine with the economy, right?

|

2021 will be better than 2020, yes?

|

The coming week will offer some time for reflection, and be thankful for some things. Yet, it should also be a time to seriously wonder whether 2021 will be any better than this year. Do you not recognise Covid'19 will eventually evolve into Covid'20? All those vaccines produced to protect against 19, do you think they will also work for 20? Ohh, and never mind the issue of long term direct/indirect effects (positive and negative) for the vaccines, are currently unknown, as we lack any longitudinal data. But hey, I shouldn't be typing about such things, at least not here via Google.

YOU, or at least many of those around you, have decided to proceed on a path of darkness. It didn't have to be that way... but ignorance and mass hysteria have lead to this.

Again... if you think 2021 is going to be any better than 2020, you haven't been paying attention, as humanity continues to step ever deeper into... the twilight zone.

--

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! For details and the latest

offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.