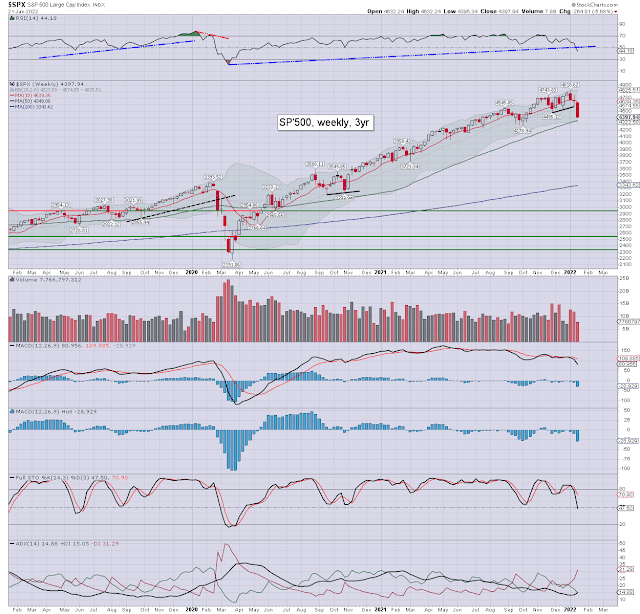

It was a very bearish week for US equity indexes, with net weekly declines ranging from -8.1% (R2K), -7.5% (Nasdaq comp'), -5.7% (SPX), -4.8% (NYSE comp'), -4.6% (Dow), to -4.1% (Trans).

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes were powerfully net lower for the week.

The R2K lead the way lower, with the Transports most resilient.

More broadly, all six US equity indexes are currently trading under their respective monthly 10MA. A January settlement under the 10MA would merit alarm bells.

Monthly momentum has turned negative in the Nasdaq comp' and the R2K, and it merits alarm bells.

–

Looking ahead

An exceptionally busy week is ahead, with a literal truck load of earnings, along with the first FOMC of the year.

Earnings:

M - HAL, IBM, STLD, LOGI

T - JNJ, GE, VZ, AXP, LMT, MMM, NEE, RTX, MSFT, TXN, COF, NAVI

W - BA, T, FCX, ABT, ANTM, TSLA, INTC, LRCX, LEVI, NOW, LC, STX, LVS, XLNX

T - MA, NUE, MCD, VLO, JBLU, MO, LUV, AAPL, HOOD, V, X, WDC

F - CVX, PSX, CAT

-

Econ-data/events

M - PMI manu', PMI serv'

T - Case Shiller, consumer con'

W - Intl' trade, new home sales,

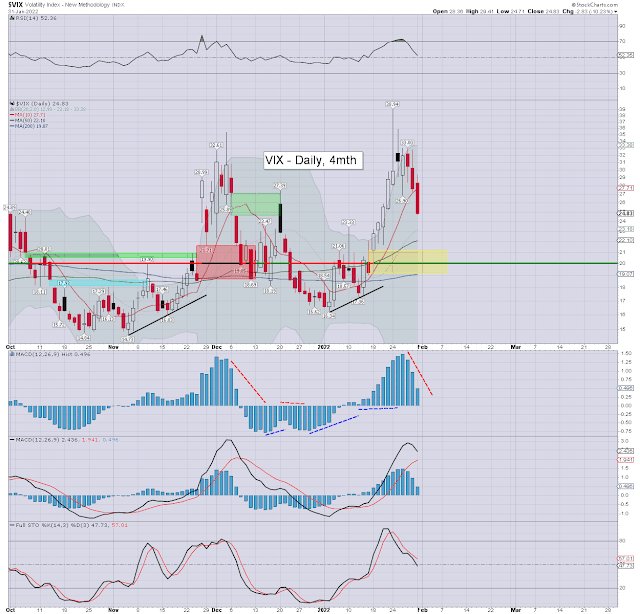

*FOMC announcement 2pm. Press conf' 2.30pm. Whilst no change in policy can be expected, the fed will likely reiterate the printers are in the process of being fully spun down, with rate hike'1 due at the subsequent FOMC of March 16th.

T - GDP Q4 (print'1), weekly jobs, durable goods orders, pending home sales

F - Pers' income/outlays, employment cost, consumer sent'

-

Final note

Friday's close was pretty ugly, with the SPX settling under the 200dma for the first time since June 2020. There is zero sign of a s/t floor, with next support of the lower weekly bollinger at 4323. Further supports are the Oct'2021 low of 4278, psy'4k, and then the 38% fib' (of March 2020>Jan'2022) of 3815.

Ohh, and lets be clear, even the 3800s would not merit use of the C word... crash. All those crash callers - who were touting it EVERY SINGLE DAY across 2021, are now saying 'see.... we told you so!'. They are still to be seen for what they are... single minded maniacs, with nothing original or useful to say.

I'd keep in mind all those millions of retail amateurs who jumped aboard the equity train in spring 2020, who haven't experienced an equity drop of any real significance. Mr Market will want to 'break' as many of those Robinhood margin-long lunatics as possible.

For those that revel in the drama, the US equity market is always the place to be... especially this coming week!

For charts, charts, more charts, and whatever else I want to highlight... you know where to find me.

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! For details and the latest

offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.