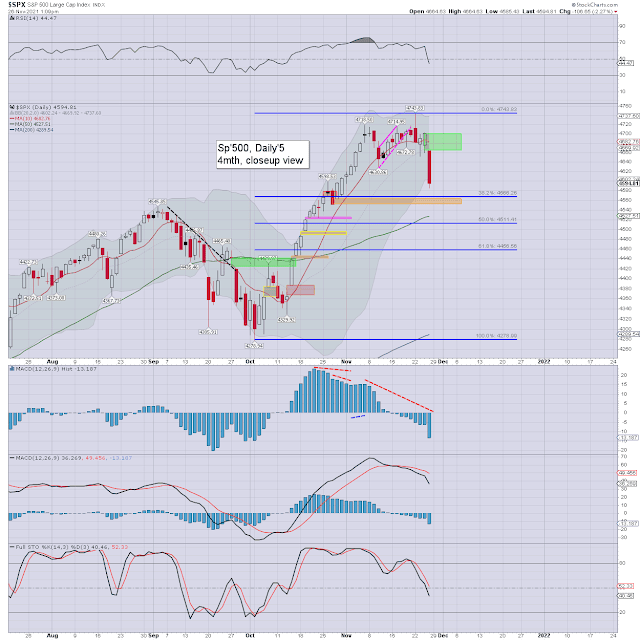

US equity indexes closed very significantly lower, SPX -88pts (1.9%) at 4567. Nasdaq comp' -1.5%. Dow -1.8%. The Transports settled -3.2%. R2K -2.0%.

SPX - daily5

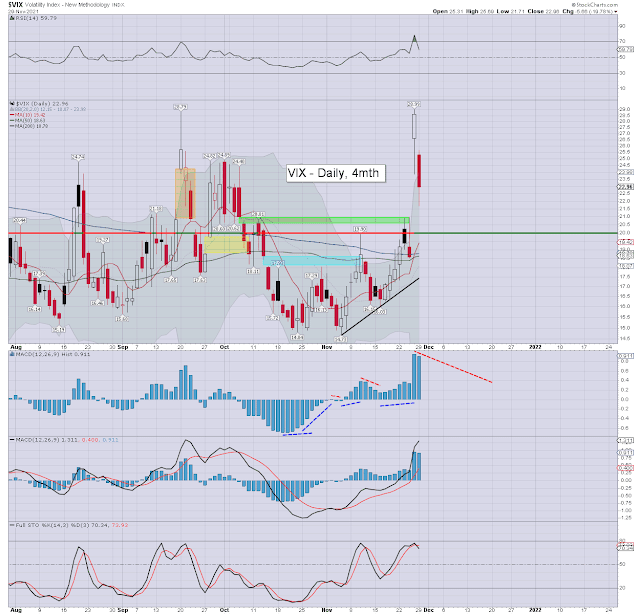

VIX - daily3

Summary

US equities opened broadly weak, but there was an early reversal, with the Nasdaq turning positive. Yet... the Fed's Powell and US T-Sec' Yellen then appeared...

Powell said that 'it was time to retire transitory', and expects inflation to remain high into mid 2022. Further, there was talk that QE taper might be accelerated.

Neither equities, or the broader US capital markets were pleased to hear that, with some very significant downside into the late afternoon.

Volatility spiked, the VIX settling +18.4% to 27.19.

–

Extra charts in AH (usually around 5pm EST) @

https://twitter.com/Trading_Sunset

Goodnight

from London

--

If you value my work on Blogger, Twitter, and would like more of the same, then subscribe to my intraday service! For details and the latest offers, see: https://www.tradingsunset.com