It was a mixed week for US equity indexes, with net weekly changes ranging from +1.7% (R2K, Trans), +0.7% (Dow), -0.5% (NYSE comp'), -2.0% (SPX), to -3.6% (Nasdaq comp').

Lets take our regular look at six of the main US indexes.

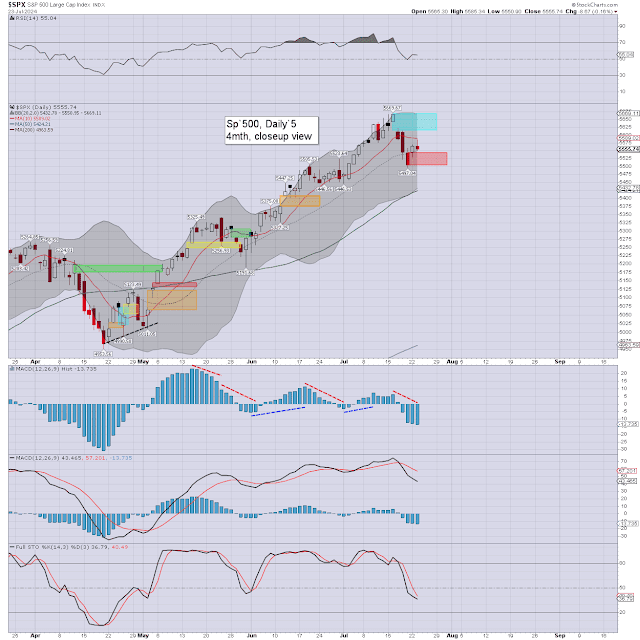

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

Three US equity indexes were net lower for the week, with three net higher.

The two leaders - Trans/R2K, lead the way up, whilst the Nasdaq comp' was powerfully lower.

The SPX, Nasdaq comp', Dow, and NYSE comp' broke new historic highs.

–

Looking ahead

Earnings:

M - $VZ $TFC $BOH $HBT $CLF $NUE $NXPI $SAP $MEDP $CCK $CDNS $AGNC $ARE $ZION

T - $SPOT $UPS $GE $GM $KO $FCX $LMT $CMCSA $PII $PM $TSLA $GOOGL $ENPH $V $TXN $CB $STX $COF $CALM $PKG

W - $VRT $T $LAW $NEE $TMO $THC $GEV $GD $BSX $CMG $F $NOW $IBM $VKTX $LVS $NEM $CLS $WHR $WM

T - $AAL $ABBV $HAS $HON $RTX $NYCB $LUV $KDP $AZN $VLO $DXCM $SKX $TXRH $DECK $SAM $JNPR $TREE $DOC $APPF $NOV

F - $BMY $MMM $CHTR $BAH $SAIA $CNC $POR $CL $B $TROW

-

Econ-data/events

M -

T - Existing home sales, PMI serv', PMI manu'

W - New home sales, EIA Pet'

T - Q2 GDP (print'1), Weekly jobs, Durable goods orders, Intl' trade, retail/wholesale invent'

F - Pers' income/outlays, PCE, consumer sent'.

-

Final note

Despite what some might say, it was a mixed week. Sure, the Nasdaq had a difficult week, but even that index broke a new historic high. With just a trio of consecutive down days, a fair number are already losing their minds.

To be clear, this week's bearish engulfing candles do merit serious consideration. The market will be vulnerable, especially within Sept/Oct', but unless m/t support is taken out, the broader trend is to be seen as bullish.

Its pretty lame how many are frequently lost within the minor noise, but that has always been the case. If want someone who will always put things into perspective, you know where to find me.

Summer subscription offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 4.20pm EDT on

Monday.