It was a bearish week for US equity indexes, with net weekly declines ranging from -6.2% (Trans), -2.6% (Nasdaq comp'), -2.5% (SPX, R2K), -2.4% (NYSE comp'), to -2.1% (Dow). Near term outlook offers s/t capitulation.

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

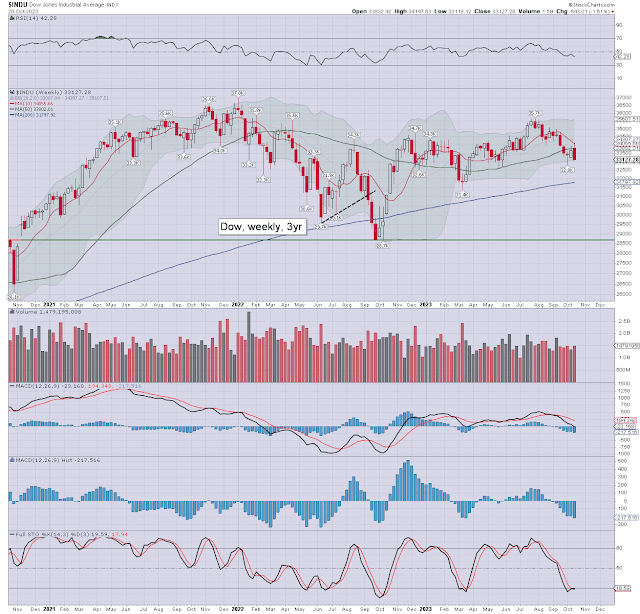

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes settled net lower for the week.

The Transports lead the way down, whilst the Dow was resilient.

Weekly momentum is increasingly negative, and will remain a restraint on ALL bounces into and across November.

–

Looking ahead

An exceptionally busy week is ahead, with a truck load of earnings, an FOMC, and some key jobs data.

Earnings:

M - SOFI, MCD, ON, WDC, HSBC, JKS, XPO, PINS, RIG, AGNC, VFC

T - PFE, CAT, JBLU, CCJ, ETN, AMGN, BP, EPD, MPC, AMD, FSLR, PAYC, CZR, LUMN, LTHM, MTCH

W - NCLH, CVS, HUM, W, KHC, GNRC, EL, PYPL, ROKU, QCOM, SMCI, SEDG, ABNB, ETSY, MELI, ALB, ELF

T - PLTR, SHOP, LLY, MRNA, CROX, GOLD, PENN, CI, COP, AAPL, $SQ, DKNG, CVNA, FTNT, SBUX, COIN, PXD, NET

F - FUBO, ENB, CBOE, CAH, EOG, IEP, CNK,

-

Econ-data/events

M - -

T - Employment cost, Case-Shiller HPI, Consumer con'.

W - ADP jobs, JOLTS, ISM manu', construction,

*FOMC announcement 2pm. Press conf' 2.30pm

T - Weekly jobs, productivity/cost, factory orders

F - Monthly jobs, ISM/PMI serv'

*UK/European clocks move back one hour as of 2am Sunday Oct'29th. The USA will follow Nov'5th.

**as Tuesday is end month, I'd expect very dynamic price action on spooky high vol'.

-

Final note

The coming week threatens a mini crash. I say 'mini', as 4K would 'barely' count. Even a brief foray to the 3700/3600s wouldn't merit as a major crash. Most have little perspective on such things, getting overly hysterical on small swings of a few percent.

Regardless of what happens next week, the ultimate issue is that its beyond any doubt, that the market maxed out in July/August. The bigger monthly charts all display a clear rollover, with SPX monthly momentum having turned negative on Friday.

If you're not hearing alarm bells... maybe you need to see a doctor. For those who are hearing the bells, you know the time to prepare has long since past. Either you're ready by now... or you're out of time.

The trading opportunities into and across 2024 will be astounding, not least for the crazy options traders who have at least some degree of risk management.

On consideration, I think its appropriate to quote young Skywalker...

"This is where the fun begins".

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! For details: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 4.20pm EST on

Monday.