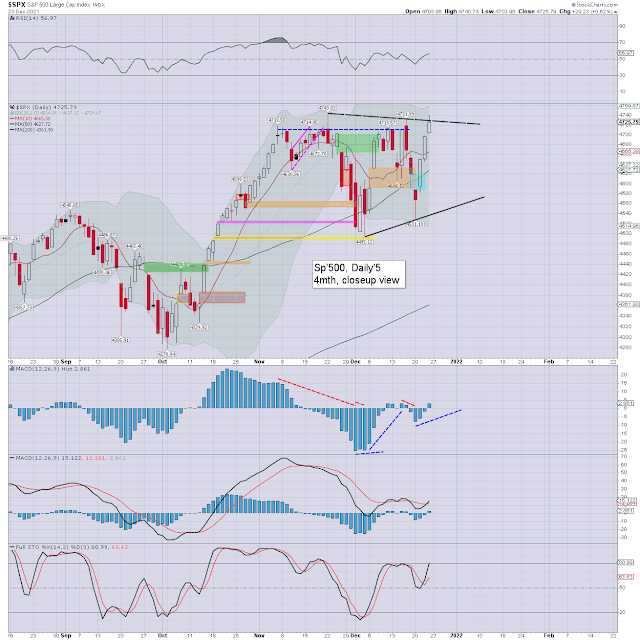

It was a bullish week for US equity indexes, with net weekly gains ranging from +3.2% (Nasdaq comp', R2K), +2.3% (SPX, Trans), +1.8% (NYSE comp'), to +1.6% (Dow). Near term outlook offers upside into early 2022.

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes settled net higher for the week.

The Nasdaq comp' and R2K lead the way upward, with the Dow lagging.

The Nasdaq comp' and R2K settled with bullish engulfing weekly candles, which bode distinctly s/t bullish.

More broadly, the SPX, Nasdaq comp', Dow, NYSE comp', and Transports are

currently still above their respective monthly 10MA, whilst the R2K is

below.

–

Looking ahead

The schedule is very light...

Earnings:

M -

T - CALM

W - FCEL

T -

F -

-

Econ-data/events

M - -

T - Case-Shiller HPI

W - Intl' trade, pending home sales, EIA Pet'

T - Weekly jobs, Chicago PMI

F - -

*As Friday is the last trading day of 2021, I would expect considerable chop, on distinctly higher vol'.

-

Final note

With an upward swing from the Monday low of sp'4531 to 4740, it was a week for the equity bulls. The turnaround was largely due to reduced fear of the latest C19 variant, but there are the usual other reasons, not least short covering, and bullish chasing.

If you look around, you can see the crash calling maniacs have once again crawled back into their dirty basements. When will they learn? Are they really still buying SPY Puts? Would they really prefer a US Govt' bond to OXY, AAPL, or MU stock?

We have just five trading days left of 2021, and whether we see indexes break new historic highs before year end or not until January... it makes little difference. This market remains m/t strong, and I've few concerns until the late spring/mid year.

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! Christmas offers, see:

https://www.tradingsunset.comEnjoy the Christmas break!

--

*the next post on this page will likely appear 5pm EST on Monday.