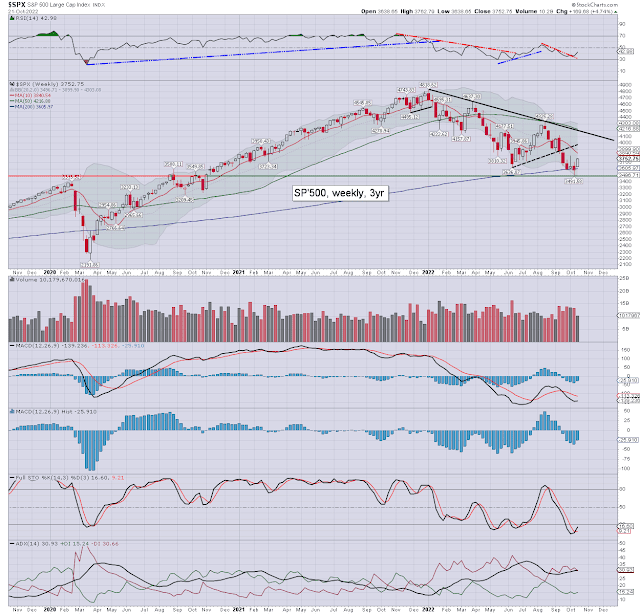

It was a bullish week for US equity indexes, with net weekly gains ranging from +5.2% (Nasdaq comp'), +4.9% (Dow), +4.7% (SPX), +3.9% (NYSE comp'), +3.5% (R2K), to +1.5% (Transports).

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes saw net weekly gains.

The Nasdaq comp' lead the way higher, whilst the Transports lagged.

More broadly, all six US equity indexes are trading under their respective monthly

10MA, with negative momentum. By definition, all six

indexes are m/t bearish.

–

Looking ahead

A busy week is ahead, with a truck load of earnings, and the first print of Q3 GDP

Earnings:

M - PHG, LOGI, RRC, AGNC, DFS

T - UPS, GM, KO, CLF, HAL, GE, VLO, MMM, JBLU, RTX, MSFT, GOOGL, ENPH, V, CMG, SPOT, TXN, SKX, BYD, FFIV

W - BA, WM, BMY, KHC, HLT, TMO, GD, HOG, META, F, TDOC, NOW, EQT

T - SHOP, MCD, CAT, LUV, MA, MRK, CCJ, MO, CMCSA, CS, AAPL, AMZN, INTC, PINS, X, TMUS, SWN, GILD, FSLR

F - XOM, CVX, NEE, ABBV, CL, JKS

-

Econ-data/events

M - PMI manu', PMI serv'

T - Case-Shiller HPI, FHFA HPI, consumer con'

W - Intl' trade, new home sales, EIA Pet'

T - Q3 GDP (print'1), Weekly jobs, durable goods orders

F - Employment costs, pers' income/outlays, consumer sent', pending home sales

-

Final note

This week's price action has appeared to have secured last week's low of sp'3491. In theory, it should hold into late Nov'/early Dec', as a push to around 4K looks realistic shortly after the midterms.

Thursday's GDP will merit attention. No doubt, the political and mainstream media hacks will lie, not least on the definition of 'recession'. Even if Q3 prints a positive number, that doesn't negate that Q1 and Q2 were negative, which is unquestionably a recession.

If Q3 prints negative, we could expect something along the lines of 'Ohh, don't worry, the Fed will soon pivot, and we'll have a soft landing'.

The reality into and across 2023 will be far different of course. Even when the Fed pivot, it won't much matter, as the system is breaking apart. Just look around... you know I'm right.

The only real unknown is whether a major monetary reset is coming within the next year or two, or not for some years later.

I see background chatter the Fed is already set to trial an ESG credit score for all American companies. There is also a quiet push for them to be ready to launch a Central Bank Digital Coin. The latter IS the path we're on. The 'competition' - such as Bitcoin and Ethereum, they'll surely all be made illegal, as the Fed can't have any competition, can it?

We've just six trading days left of October. Expect some chop, but 3491 looks secure, ahead of the midterms.

The cold winds of winter will soon be here, and then we'll really start to see just how much physical and psychological pain the European and North American populace can take, before the system breaks apart even further.

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! For details and the latest

offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.