It was a mixed week for US equity indexes, with net weekly changes ranging from -2.1% (R2K), -1.2% (NYSE comp'), -1.1% (Trans), -0.3% (Dow), +0.5% (SPX), to +1.6% (Nasdaq comp'). Near term outlook is bullish.

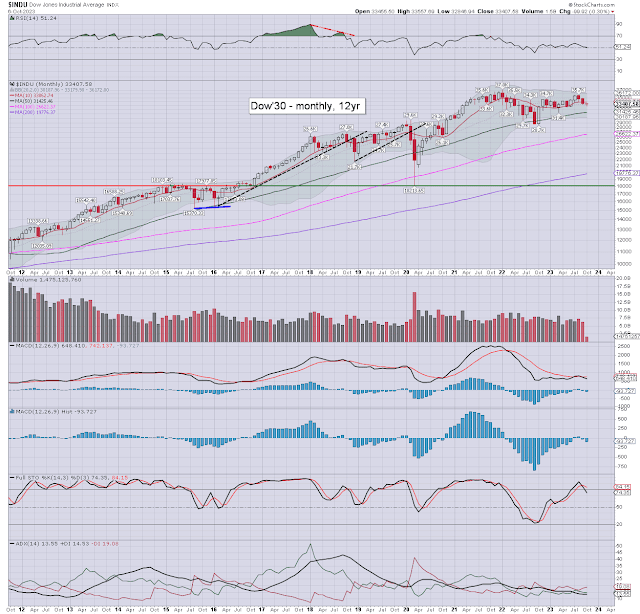

Lets take our regular look at six of the main US indexes (monthly candle charts).

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

Four US equity indexes were net lower for the week, with two net higher.

The R2K was very significantly lower, whilst the Nasdaq was very significantly higher.

More broadly, the SPX and Nasdaq comp' are trading above their respective monthly 10MA, if marginally.

The SPX, Nas', and Transports, have positive monthly momentum, but all look prone to turning negative by end month, or as of Nov'1st.

–

Looking ahead

A busier week is ahead, with Q3 earnings season - starting with the financials. The market will be especially interested in the latest PPI and CPI data.

Earnings:

M -

T - PEP

W -

T - DAL, WBA, CMC, DPZ, FAST, INFY

F - JPM, C, WFC, BLK, PNC, UNH, PGR

-

Econ-data/events

M -

T - Wholesale invent'

W - PPI, EIA Pet' report, FOMC mins (2pm)

T - CPI, weekly jobs

F - import prices, consumer sent'

-

For details: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 4.20pm EST on

Monday.