It was a bearish week for US equity indexes, with net weekly declines ranging from -3.2% (Nasdaq comp'), -2.4% (SPX), -2.2% (R2K), -1.9% (NYSE comp'), -1.7% (Trans), to -1.6% (Dow). Near term outlook is distinctly bearish.

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

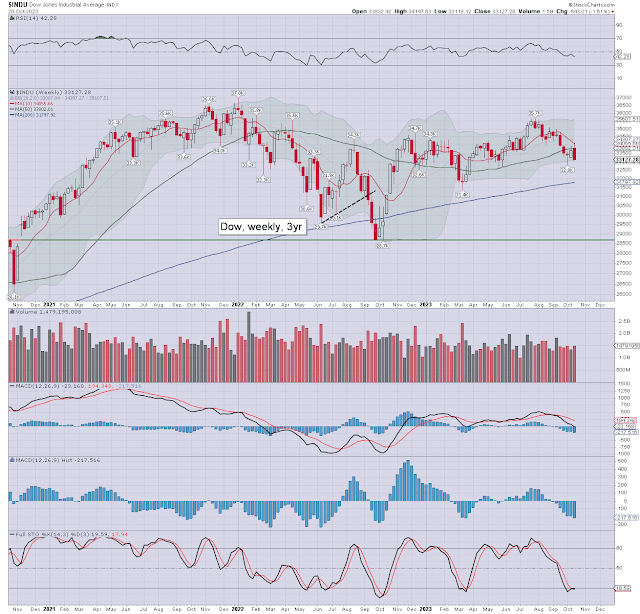

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes settled significantly lower for the week.

The Nasdaq lead the way down, with the Dow most resilient.

The weekly candles are bearish engulfing, with an upper spike, indicative of exhausted bulls.

Weekly momentum is increasingly negative, and will be a restraint on ALL bounces into and across November.

Trading volume is picking up, as the mainstream cheerleaders and 'smart guys' are starting to get spooked.

–

Looking ahead

Earnings:

M - PHG, BOH, HOPE, CLF, CDNS, MEDP, LOGI, CCK

T - KO, VZ, GE, RTX, MMM, ADM, SPOT, NEE, CNC, GM, MSFT, GOOGL, SNAP, V, TDOC, TXN, BYD, RRC, WFRD

W - BA, TMO, TMUS, HLT, ADP, CNX, GD, LAD, META, IBM, NOW, ALGN, KLAC, ORLY, BKR, NLY, EW

T - RCL, UPS, HSY, MO, LUV, NOC, VLO, TSCO, MRK, NEM, AMZN, INTC, F, CMG, ENPH, SKX, X, COF, VALE

F - XOM, CVX, PSX, ABBV, CHTR, AN, CL, NWL TROW

-

Econ-data/events

M - -

T - Case-Shiller HPI, PMI serv', PMI manu'

W - New home sales

T - GDP Q3 (print'1), Weekly jobs, durable goods, intl' trade, pending home sales

F - Pers' income/spending, PCE, consumer sent'.

-

Final note

Tuesday's reversal from sp'4393 was indeed pivotal, with the bulls unwilling to buy into the 4400s. Those watching the tick for tick price action, should have noticed the market is becoming increasing unstable. This week's VIX settlement above the key 20 threshold merits attention, as the 30s look due.

Friday's close in the SPX was decisive, not only settling under m/t rising trend - from the Oct'2022 low, but also under the daily 200MA and monthly 10MA.

Monday looks prone to a major gap lower, with next support of psy' 4K. Below that, we've the March low of 3808, and then the 3600s.

Even if the middle east situation doesn't escalate, the sheer technical setup for the US market leans distinctly bearish into end month.

It is somewhat amusing that many of those just recently touting a major rally into year end, are crawling back under their dirty rocks, where they would do well to remain into 2024.

The time to prepare has passed. The next seven trading days should be extraordinarily dynamic.

Yours... with a seat at the most entertaining, twisted, and rigged casino in the world.

For details>> see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 4.20pm EST on

Monday.