It was a bearish week for US equity indexes, with net weekly declines ranging from -5.2% (Trans), -5.0% (R2K), -4.0% (Nasdaq comp'), -3.4% (SPX), to -3.0% (NYSE comp').

Lets take our regular look at six of the main US indexes (monthly candle charts).

sp'500

Nasdaq comp'

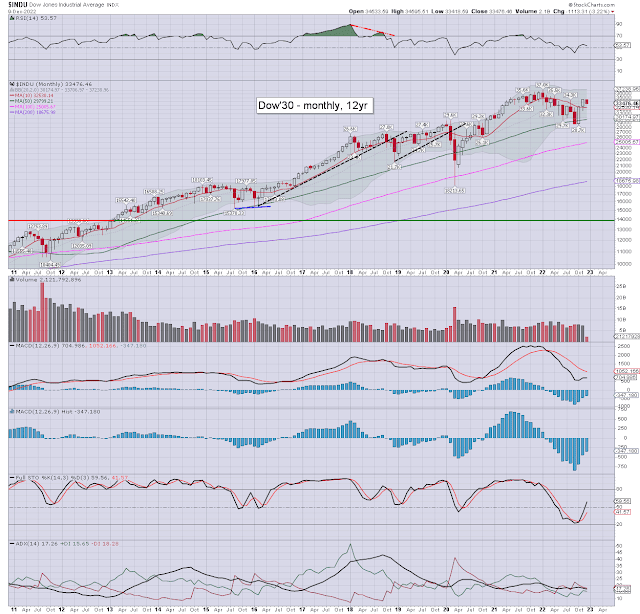

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes saw net weekly declines.

The 'old leader' - Transports, lead the way down, with the NYSE comp' most resilient.

More broadly, the SPX, Nasdaq comp', R2K, and Transports are back under their respective monthly 10MA. The exceptions being the Dow and NYSE comp'. All six US indexes have negative monthly momentum.

–

Looking ahead

The week will be centered on the latest inflation data, with the Fed set to raise rates on Wednesday. It will effectively be the last big week of 2022.

Earnings:

M - ORCL, COUP

T - ABM

W - WEBR, LEN, TCOM, NDSN

T - JBIL, ADBE

F - ACN, DRI, WGO

-

Econ-data/events

M - US T-budget

T - CPI

W - Import prices, EIA Pet' report.

*2pm FOMC announcement. Rate hike seven, 50bps to 4.25-4.50% can be expected. Powell will host a press conf' at 2.30pm

T - Weekly jobs, retail sales, Empire State manu', Phil' Fed' manu, Indust' prod', Busi' invent'

F - PMI manu', PMI serv', *quadruple option expiration*

*As Friday is quad-opex, expect considerable chop on very high vol'.

-

|

| Just another nine sunsets until winter solstice |

Final note

We have just fourteen trading days left of the year. Whilst we've seen a powerful rally from early October, regardless of exactly where 2022 settles, it has been one for the bears.

The week ahead should offer some dynamic price action, as the market is increasingly forced to look ahead, not least in terms of the economy, but as to what the Fed will do.

Just over a year ago, Print Central reiterated that rates would remain at zero until end 2024. So... whatever the Fed/Powell says this week, I'd treat it will utter derision. The only issue is when do they stop raising rates, and at what level?

As an aside, historically, the ultimate equity sell signal has been a rate cut, and it remains amusing how few recognise this. So if you expect rates to max out at around 5.0% within H1 2023, when they do cut... you will hopefully remember the implications.

|

| The nights are long and increasingly icy |

A tough winter is ahead, especially for those in the failed state of the UK, and broader mainland Europe. Its difficult to guess if this is the winter when rolling blackouts become a regular feature, but it should be clear.... they are coming.

The time to prepare has come... and gone. Now its just a case of how difficult it gets.

The implications of an increasingly stressed and financially broken populace can't be over-stated. Do you think the sheep/serfs are planning their summer vacation, or you do think they are more focused on whether they can afford a few hours of heating, in addition to next week's grocery shopping?

For most... it just gets harder from here, all the way into the 2030s. By then... things will be very different. I would hope most of you know the various key trends... and the path where we're headed. One thing is for sure, life on planet Krazy is never going to be boring.

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! For details and the latest

offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.