It was a bullish week for US equity indexes, with net weekly gains ranging from +1.9% (NYSE comp'), +1.8% (Dow), +1.5% (SPX), 1.3% (Trans), +1.1% (R2K), to +0.7% (Nasdaq comp').

Lets take our regular look at six of the main US indexes

sp'500

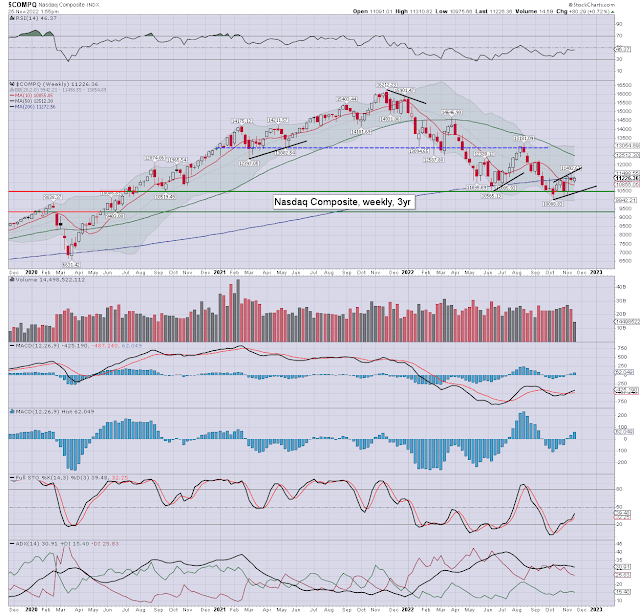

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes settled net higher for the week.

The NYSE comp' lead the way upward, whilst the Nasdaq comp' lagged.

–

Looking ahead

Earnings:

M - PDD

T - BILI, CRWD, INTU, WDAY, HPE

W - WOOF, SNOW, CRM, SPLK, FIVE, VSCO, BOX

T - DG, KR, BIG, TD, LE, CHPT, ULTA, MRVL, ZS, AMBA

F - CBRL

-

Econ-data/events

M -

T - Case-Shiller HPI, FHFA HPI, Consumer con'.

W - ADP jobs, Q3 GDP (print'2), intl' trade, Chicago PMI, JOLTS, Pending home sales. Powell (1.30pm), Fed Beige book (2pm).

T - Weekly jobs, pers' income/outlays, PMI/ISM manu', construction, vehicle sales

F - Monthly jobs

*as Wednesday is end month, I'd expect more dynamic price action on higher vol'.

-

Final note

We're set to enter the last twelfth of the year. Despite a major bounce from early October, its unquestionably been a year for the bears. Ohh, and to be clear, I'm not saying we have any sign of a s/t ceiling. Having printed sp'4034 this past week, the bulls are still in control.

Meanwhile, we have the usual suspects - such as Cramer, and the Tom Lee, whom are increasing in confidence and arrogance again. They WANT to believe a key mid term floor is in. They NEED to believe a key floor is in. The other thought... that 2023 will be as bad, or worse, is UNTHINKABLE to them.

If you look around... you can see what is happening, as the path into and across 2023 is going to be an increasingly difficult one. I'm hopeful that most of you have long since planned and acted accordingly.

Black Friday offers >>> https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.