It was a bearish week for US equity indexes, with net weekly declines ranging from -2.1% (Transports), -1.7% (R2K), -1.6% (Nasdaq comp'), -0.7% (SPX), -0.3% (NYSE comp'), to -0.01% (Dow).

Lets take our regular look at six of the main US indexes

sp'500

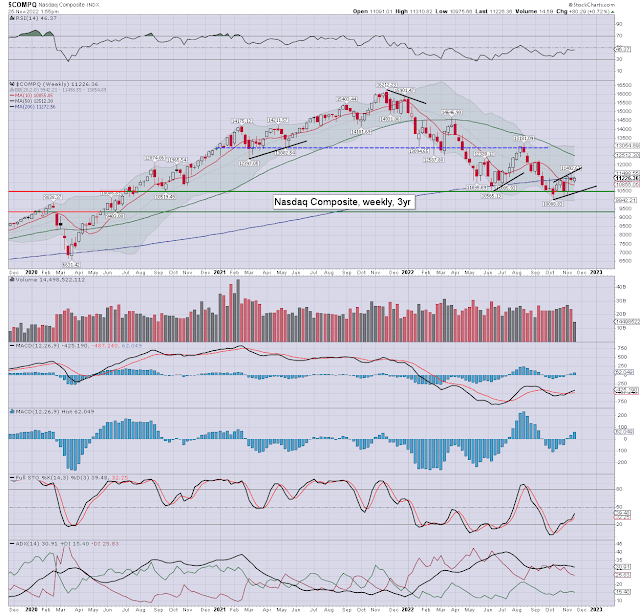

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes saw net weekly declines.

The Transports lead the way down, whilst the Dow was very resilient.

More broadly, all six indexes are currently net higher for the month. The Dow, NYSE

comp', and Transports are above their respective monthly 10MA. All

six indexes still have negative monthly momentum.

–

Looking ahead

It will be a short 3.5 trading day week, with the market closed for Thanksgiving.

Earnings:

M - FUTU, NIU, SJM, ZM, DELL, UAA

T - BBY, DLTR, DKS, BIDU, CSIQ, ADI, MDT, BURL, ANF, JACK, CAL, ADSK, JWN, HPQ, GES

W - DE

T - -

F - -

-

Econ-data/events

M - Chicago Fed Nat' Act'

T - -

W - Durable Goods Orders, weekly jobs, PMI manu' & serv', consumer sent', new home sales, FOMC minutes (2pm).

T - CLOSED for Thanksgiving

F - *EARLY CLOSING 1pm*

-

|

Winter Solstice is just over a month away.

|

Final note

It was a net bearish week, although the bulls can tout new multi-week highs.

Do you hear it? You must hear it, yes?

... the sounds of the breaking economy. Those who were around in 2007 should recognise the sounds... or rather 'signs' of an economy continuing to splinter apart. Whether its housing, the jobs market, vehicle sales, or the increasingly broken consumer, it should be undeniable to anyone who doesn't have their eyes (or ears) wide shut.

The US and wider global economy faces increasing strains into 2023. None of this gloomy outlook even considers any of the 'wild cards' playing out... China/Taiwan being a prime one. It merely assumes increasing job losses, and sustained high inflation. Do you really think spring 2023 will be better for the economy and/or market than the present?

I could understand the more bold shorting something early next week, if only for a day or two ahead of the Thanksgiving break. The more cautious bears will continue to wait for a momentum cyclical rollover on the weekly charts. In theory, we should see that within 1-2 weeks.

It should be clear, the October low of sp'3491 is not a m/t floor. Perhaps the real question most should be asking, is whether the market will retrace all the way back to the March 2020 lows. My guess is... yes.

Unlike some out there... yours truly is an independent. I'm sponsored by no one, I'm beholden... to no one. For more of the same... you know where to find me.

For details see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.