It was a mixed week for US equity indexes, with net weekly changes ranging from -2.6% (Nasdaq comp'), -2.1 (SPX), -1.1% (NYSE comp'), -0.8% (Dow), +0.5% (R2K), to +2.6% (Transports).

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

R2K

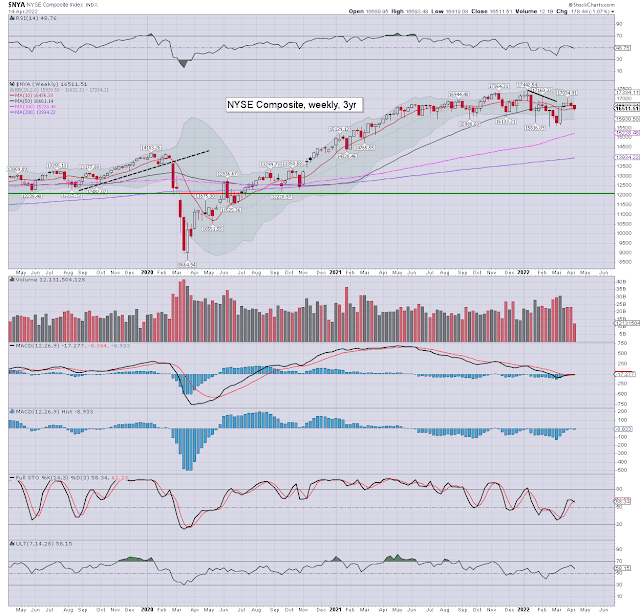

NYSE comp'

Trans

–

Summary

Four US equity indexes were net lower for the week, with two net higher.

The Nasdaq comp' was very significantly lower, whilst the Transports was very significant higher.

More broadly, all six indexes are currently trading under their respective monthly 10MA, and are thus to be seen as m/t broken.

–

Looking ahead

A busy week is ahead, as earnings will increasingly pour in.

Earnings:

M - BAC, SCHW, BK, JBHT

T - NFLX, HAL, JNJ LMT, IBM, HAS, TRV, IBKR

W - TSLA, AA, PG, ANTM, UAL, LRCX, ABT, STLD, KMI, CSX

T - AAL, SNAP, T, NUE, FCX, DOW, UNP, PM, ISRG

F - CLF, VZ, SLB, AXP, NEM, KMB, HCA

-

Econ-data/events

M - Home Builders Index

T - Building Permits, Housing starts

W - Existing home sales, EIA Pet', Fed Beige book

T - Weekly jobs, leading indicators

F - PMI manu', PMI serv'

-

|

| A fine end to Good Friday |

Final note

Whilst the headline indexes were net lower, the two leaders - Trans/R2K, managed net weekly gains, and are suggestive the market will be inclined for another wave upward. To be clear, I'm bearish early next week, but then expecting some upside.

This past week's inflation print of 8.5% sure wasn't pretty, and now its merely a case of whether the 9s are printed in May or June. The Fed is clearly going to raise rates May 4th and June 15th, but I'm increasingly of the view that will be it, not least if equities spiral downward into early summer.

Regardless of next week, I'll be more focused on how April settles. Bears should be content with SPX <4500, anything <4400 would be a bonus.

For more of the same, you know where to find me.

Enjoy the Easter weekend

--

*the next post on this page will likely appear 5pm EST on Monday.