US equity indexes mostly closed a little higher, SPX +19pts (0.4%) at 4500. Nasdaq comp' +0.1%. Dow +0.2%. The Transports settled +0.3%. R2K -0.3%.

SPX - daily

VIX - daily

Summary

US equities saw minor pre-market gains fade to significant declines by late morning. There was an afternoon recovery to see all six of the main indexes turn positive, but overall price action wasn't pretty, with some moderate cooling in the final minutes.

--

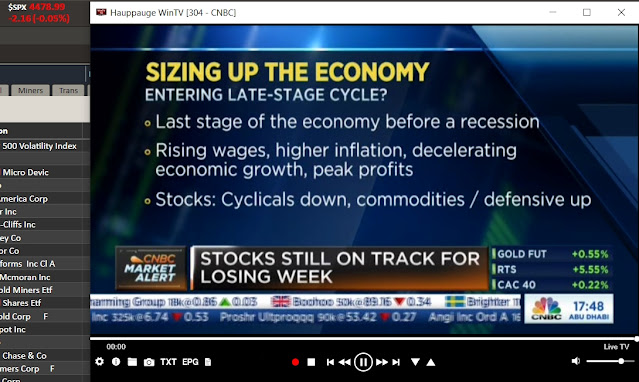

Pisani of CNBC highlighted this...

Indeed, all the signs are that we're in the late stage of an economic cycle. The irony being, rather than monetary easing, the Fed need to raise rates and inverse-print, to help cool inflation.

If your 'innovative' loss making, zero yield stocks are struggling during the 'economic growth phase', how do you think they'll perform during a slow down, or outright recession?

--

|

| Raise your hand, if you like loss making, zero yield companies. |

Considering the broader macro-economic outlook, I still have to expect Ms. Wood of ARK to eventually step down. No doubt the mainstream media hacks will be fawning all over her, and come up with excuses such as 'ohh... it was just unfortunate timing', or 'its the Fed's fault that innovation is struggling'.

-

Volatility was mixed, the VIX printing 23.82, but settling -2.5% to 21.55. It'd be useful to the equity bears if the VIX can settle the week above the key 20 threshold.

-

|

| Bullish golden sunshine |

|

| Spring showers |

|

| Next full moon is Apr'16th |

|

| 332x, pretty good for a handheld camera |

–

Extra charts in AH (usually around 5pm EST) @

https://twitter.com/Trading_Sunset

Goodnight

from London

--

If you value my work on Blogger, Twitter, and would like more of the same, then subscribe to my intraday service! For details and the latest offers, see: https://www.tradingsunset.com