It was a mixed week for US equity indexes, with net weekly changes ranging from -0.6% (SPX, Nasdaq comp'), -0.03% (Dow), +0.5% (NYSE comp'), to +1.3% (Transports).

Lets take our regular look at five of the main US indexes

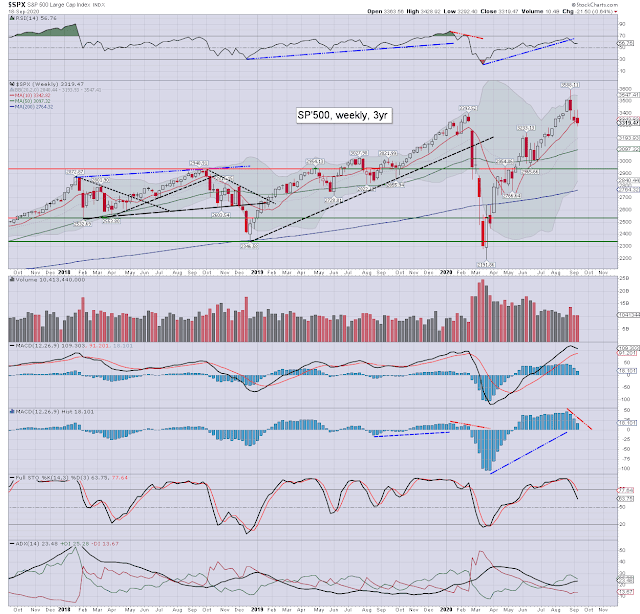

sp'500

A third consecutive net weekly decline, settling -21pts (0.6%) to 3319, with an intra low of 3292. Weekly momentum ticked lower for a third week, and is set to turn negative within 1-2 weeks. I would note the June high of 3233.

Nasdaq comp'

A third week lower, settling -60pts (0.6%) to 10793. Weekly momentum is set to turn negative next week, and I would note the Feb' high of 9838.

Dow

A third consecutive net weekly decline, if by a fractional -8pts (0.03%) to 27657. Weekly momentum is set to turn negative in 2-3 weeks.

NYSE comp'

The master index saw a moderate net weekly gain of +60pts (0.5%) to 12833. The weekly black candle leans s/t bearish, and I would note the April high of 11675.

Trans

The Transports was very resilient to the main market, breaking a new historic high of 11690, and settling +149pts (1.3%) to 11431. This week's candle is rather spiky, and is subtly indicative of s/t bullish exhaustion.

–

Summary

The SPX and Nasdaq settled moderately net lower, the Dow was effectively flat, whilst the NYSE comp' was moderately higher, with the Transports significantly higher.

The Transports broke a new historic high.

More broadly, all five indexes are holding above their respective monthly 10MA, as the m/t trend remains outright bullish.

–

Looking ahead

The schedule is pretty light, and that will give the market some time to focus on other things, not least the election.

Earnings:

M -

T - AZO, NKE, ACB, SFIX, KBH

W - GIS, CTAS, FUL

T - RAD, KMX, DRI, ACN, BB, JBL, COST, TRIP, MTN

F -

-

Econ-data:

M - Chicago Nat' act'

T - Existing home sales

W - PMI serv', PMI manu', EIA Pet'

T - Weekly jobs, new home sales

F - Durable goods orders,

-

|

| Fading summer |

Final note

We're another day, and another week closer to the election, with the death of Ginsberg raising the political and societal tensions even further.

A few weeks of equity cooling has done nothing to dent the m/t bullish trend. Even a foray into the mid/low sp'3100s wouldn't do any significant technical damage, so long as we quickly reverse from around there.

It remains my view that Trump will win a second term. It should be clear, the equity market would be pleased with that outcome. Further, we're clearly going to get more fiscal stimulus, whether before... or sometime after the big vote.

As summer continues to fade away, I will merely say... enjoy each day, as best you can, as you never know... when your time might be up... in the twilight zone.

If you value my work on Blogger and Twitter, subscribe to my

intraday service.

For details/latest offers, see:

https://www.tradingsunset.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.