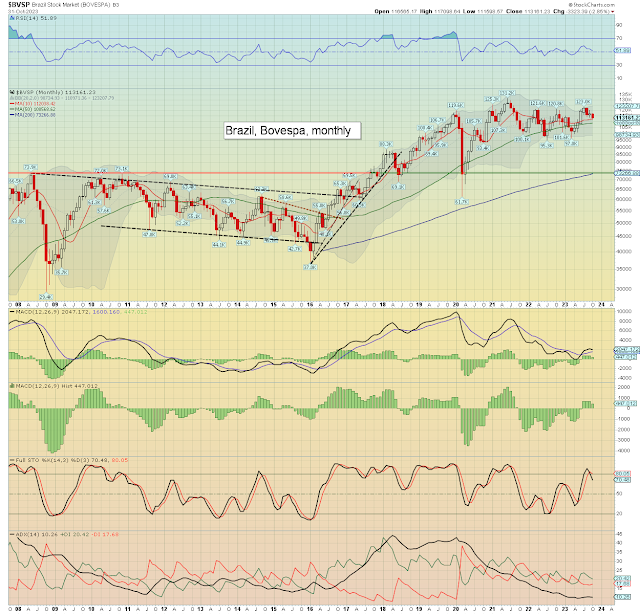

It was a bearish month for most world equity markets, with net monthly changes ranging from -3.9% (Hong Kong, Australia), -3.7% (Germany), -3.1% (Japan), -3.0% (India), -2.9% (China), -2.8% (Brazil), -2.7% (South Africa), -1.4% (USA), to +7.2% (Russia).

Lets take our regular look at ten of the world equity markets.

USA - Dow

Germany – DAX

Japan – Nikkei

Brazil – Bovespa

Russia - RTSI

India – SENSEX

China – Shanghai comp'

South Africa – Dow

Hong Kong – Hang Seng

Australia – AORD

–

Summary

Nine world markets settled net lower for October, with one market net higher.

Hong Kong and Australia lead the way down, whilst Russia was very powerfully higher.

Japan, Brazil, Russia, and India settled above their key monthly 10MA.

Germany, Japan, Brazil, Russia, and Hong Kong settled with positive monthly momentum.

-

Looking ahead

The schedule is somewhat lighter, which might give the market some time to consider the middle east situation.

Earnings:

BRK.b (Saturday)

M - BAM, DISH, BNTX, O, HIMS, NXPI, VRTX, FANG, CLOV, CTRA, TRIP, FGEN, CE

T - UBER, CELH, DDOG, DHI, MLCO, VTNR, EMR, RIVN, DVN, OXY, MOS, GILD, WISH, UPST, AXON, BROS, TOST

W - RBLX, FSR, WBD, NVEI, FSS, UAA, BIIB, AMC, DIS, TWLO, MARA, AFRM, APPS, SPCE

T - LI, NVAX, FVRR, YPF, YETI, TPR, PLUG, U , TTD, WYNN, PBR, CGC, ACB, NVTS

F - AU, AQN

-

Econ-data/events:

M - -

T - Intl. trade, consumer credit (3pm)

W - *Powell, 9.15am, Wholesale invent', EIA Pet'

T - Weekly jobs, *Powell, 2pm (IMF)

F - -

*US clocks will move back one hour at 2am, Sunday Nov'5th.

--

|

| The nights are growing cold |

Final note

Whilst November has started on a very positive note, the collective of world equity markets had a distinctly bearish October. There is no reason not to expect lower lows into year end.

Even if you dismiss the various geo-political wild cards - not least Gaza/Israel, the technical setup leans bearish into year end/early 2024.

I'm well aware of a number out there who are touting a broad run to new historic highs.

My only polite response is... Good luck with that.

For details > https://www.tradingsunset.com

Have a good weekend

--

*the next post on this page will likely appear 4.20pm EST on Monday.