It was a bullish week for US equity indexes, with net weekly gains ranging from +4.5% (Trans), +3.7% (R2K), +3.3% (Nasdaq comp'), 2.5% (SPX), +2.4% (NYSE comp'), to +1.9% (Dow).

Lets take our regular look at six of the main US indexes

sp'500

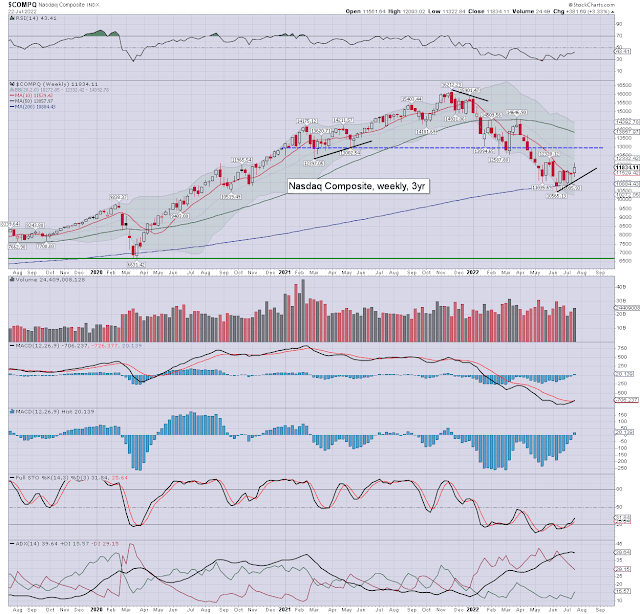

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes settled net higher for the week.

The Transports lead the way upward, whilst the Dow was the laggard.

Weekly momentum has turned positive in the Nasdaq and R2K. The other four indexes can be expected to follow within 1-2 weeks.

–

Looking ahead

An exceptionally busy week is ahead, with a monster truck load of earnings, rate hike'4, and the first print of Q2 GDP.

Earnings:

M - INFY, PHG, NEM, SQSP, DORM, NXPI, WHR, RRC, LOGI

T - UPS, KO, GM, GE, MCD, RTX, ADM, ACI, KMB, GOOGL, MSFT, V, ENPH. CMG, TXN, SKX

W - SHOP, BA, SPOT, WM, BMY, SHW, TECK, HLT, HUM, KHZ, META, F, QCOM, HOLX, TDOC, ETSY, LRCX, NOW

T - TLRY, PFE, BAX, VLO, LUV, MA, MRK, MO, BTU, HTZ, AAPL, AMZN, ROKU, INTC, X, AUY

F - XOM, CVX, PSX, PG, CL, AZN, ABBV

-

Econ-data/events

M - Chicago Fed' Nat' Act' index

T - Case-Shiller HPI, consumer con', new home sales

W - Durable goods orders, intl' trade, pending home sales, EIA Pet'

*FOMC announcement 2pm: this should detail rate hike'4 of +75bps to a range of 2.25-2.50% (matching the peak of the previous cycle in Dec'2018), and a reiteration of the QT program. Powell will host a press conf' at 2.30pm.

T - Q2 GDP, weekly jobs

F - PCE inflation, pers' income/spending, employment costs, Chicago PMI, consumer sent'

*As Friday is end month, I'd expect dynamic price action on higher vol'.

-

Final note

This week's net equity gains give extra confidence that sp'3636 is a secure s/t low. The outlook for Aug/early Sept' is bullish.

To be absolutely clear... I see this as a bear market unless we're sustainably above the monthly 10MA (4336), and the daily 200MA (4354).

The coming week will see the monetary maniacs of Print Central raise rates for a fourth time. The market is expecting 75bps (as is yours truly). Might Powell suggest they will then 'pause' ?

Thursday will see Q2 GDP, which should be negative. Considering Q1 was -1.5%, I have to expect Q2 to print worse, and would not be surprised to see -2.5%.

All those cheerleaders... lets name some names shall we...

The Tom Lee, Cramer, Lebenthal, Ms. Harrington, Kevin O'Leary, Ms. Link, and Belski,

... who have been in denial about the recession, should admit they were wrong.

Yet, we know what they'll say, don't we?

"Ohh, but the recession will be mild, and brief, I still expect a second half rebound".

Whilst I'm open to Q3 GDP actually net positive, it really doesn't matter. It should be clear, Q4, and much of 2023 are probably going to be a horror show.

There is the economic/societal basketcase of Europe, where winter 2022/23 will see a disturbing lack of energy. What do you think happens if various EU states order significant chunks of their industry to shut down, because they need the available energy for domestic customers?

A cash-strapped, cold, 'in the dark', and hungry European populous isn't going to help the US economy/market, is it?

Further, every month that inflation remains elevated (never mind any increases in the actual rate of inflation), is going to be grind the US/global consumer to dust. There is ZERO reason not to expect food/energy prices to broadly increase into 2023. I'd refer you to the producer prices data, which will typically take 9-12 months to fully feed through into consumer prices.

From a trading/investment perspective, we have the most incredible, exciting, if outright scary times ahead. I would merely suggest you enjoy the warm summer sun, as by late October, things will be... different.

Summer offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.