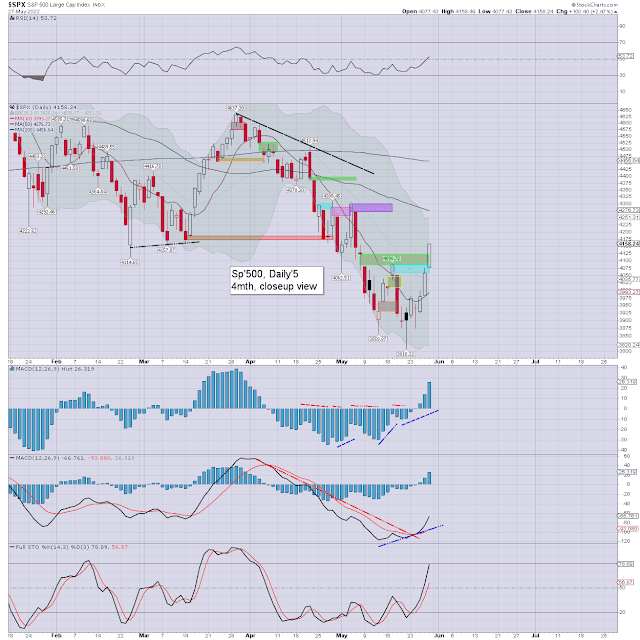

It was a bearish week for US equity indexes, with net weekly declines ranging from -6.7% (Trans), -3.8% (Nasdaq comp'), -3.0% (SPX), -2.9% (Dow), -1.2% (NYSE comp'), to -1.1% (R2K).

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes were net lower for the week.

The Transports lead the way lower, whilst the R2K was most resilient.

More broadly, all six US equity indexes are trading under their respective monthly

10MA, and have increasingly negative momentum. By definition, all six

indexes are m/t bearish.

–

Looking ahead

Earnings:

M - ZM

T - BBY, ANF, RL, WOOF, CSIQ, DSX, DOLE, SBLK, JWN, URBN, TOL

W - DKS, NVDA, SNOW, SPLK, BOX, WSM, NTNX

T - BABA, M, DLTR, DG, BKE, BIDU, MDT, JACK, BURL, COST, MRVL, ZS, ADSK, ULTA, DELL, GPS, WDAY, AEO, FTCH

F - CGC, BIG, SAFM, PDD

-

Econ-data/events

M -

T - PMI manu', PMI serv', new home sales

W - Durable goods orders, EIA Pet', FOMC mins (2pm)

T - Weekly jobs, Q1 GDP (print 2), pending home sales

F - Pers' income/spending, Intl' trade, consumer sent'.

*As Monday May 30th is CLOSED for Memorial day, I would expect the preceding Friday to be subdued on light vol'.

-

Final note

It was yet another week for the equity bears, as the US equity market remains m/t broken. Retail earnings from WMT and TGT sure didn't help.

The mainstream cheerleaders are understandably getting increasingly riled up at the Fed/Powell. Rather ironically, the Cramer is annoyed that Powell hasn't raised rates fast enough to combat inflation.

How long until Cramer is banging on the table, demanding rate cuts, and renewed QE?

What level of the SPX will be needed to see that happen?

If the Fed don't 'back off', whilst I'd expect a bounce from the 3500s to around 4K, then the problems would really begin in equity land.

For now, most are still in denial, as we're seeing every day on the CNBC lunchtime show. Growth was negative in Q1, and there is zero reason to expect Q2 to be any better.

By definition... when we have the first print of Q2 GDP - due late July, the US will officially be in recession.

How will the 'there will be no recession... the consumer is strong', cheerleaders, such as O'Leary, Belski, Ms. Link, Farmer Jim, and Ms' Harrington, respond?

Oh yeah, we know... it'll be.... "no one could have seen this coming".

As an aside, it'll be interesting to see how the Biden admin' respond to an economy in recession, and with high inflation. Perhaps... just... blame the Fed? Which in many ways... would be partly valid.

Regardless of the immediate term, big target is the lower monthly bollinger, currently in the sp'3400s, but which will have climbed to around the 3500s in June.

I am pushing hard to offer some perspective. Subscribe/support...

For details, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.