It was a mixed week for US equity indexes, with net weekly changes ranging from +2.0% (Nasdaq comp'), +1.8% (SPX), +1.1% (NYSE comp'), +0.3% (Dow), -0.4% (R2K), to -0.7% (Trans).

Lets take our regular look at six of the main US indexes

sp'500

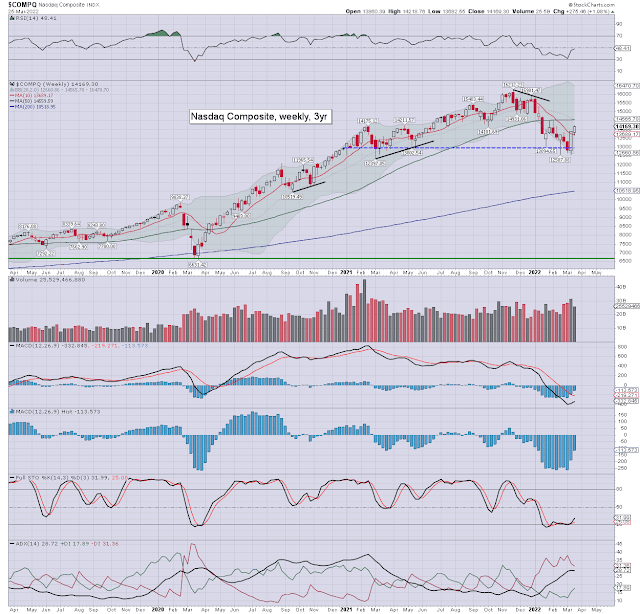

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

Four US equity indexes were net higher for the week, with two net lower.

The Nasdaq lead the way upward, whilst the two leaders - the R2K and the Transports lagged.

More broadly, the SPX, NYSE comp', and Transports are above their respective monthly 10MA.

Monthly momentum remains negative in five indexes, the exception being the Transports.

–

Looking ahead

Earnings:

M -

T - MU, RH, LULU, CHWY, PVH

W - BNTX, FIVE, PAYX

T - WBA, BB

F -

-

Econ-data/events

M- Intl' trade

T - Case-Shiller HPI, consumer con', JOLTS,

W - ADP jobs, Q4 GDP (print'3), EIA Pet'

T - Weekly jobs, pers' income/spending, Chicago PMI

F - Monthly jobs, PMI/ISM manu', construction, vehicle sales

*UK/European clocks will jump ahead 2am, Sunday, March 27th.

**As Thursday is end month/Q1, expect more dynamic price action on very high vol'.

-

|

| The sun sets on GMT |

Final note

It was a pretty strong week for small caps and tech, but the rest of the market is increasingly tired, with some s/t divergences.

We've just four trading days left of March/Q1, and for the chartists out there, how we settle next Thursday will be very important. In terms of the SPX, bulls should be seeking a decisive settlement >4500, whilst bears need <4400. Anything in between has to be seen as an indecisive zone.

Meanwhile, many of the mainstream cheerleaders are already on the 'bear market is over' train...

see: https://twitter.com/CNBCOvertime/status/1507452206890762242

First, the collective of the market was never in a bear market to begin with. Sure, the hysteria/garbage stocks were smashed by 50/75% (although that began last year). Broadly though, most stocks only saw a correction.

The Cramer, along with other 'usual suspects' - such as the Tom Lee of Fundstrat, and Ms. Wood of ARK, are out there, touting renewed upside. Yet... these same three were all distinctly bullish at the end of January.

How exactly do you think the market is going to react when headline y/y CPI prints near/above 9.0% in early April?

Another two rate hikes appear a given this May and June, but by early summer, the mainstream will be increasingly concerned about a stalling US/global economy. Then we can expect desperate calls for the fed to halt rate hikes.... even as inflation continues to climb >10%.

Get your popcorn whilst its still relatively cheap, and by late summer, it might not even be available at any price. For more of the same... you know where to find me.

For details and the latest

offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.