It was a bearish week for US equity indexes, with net weekly declines ranging from -1.9% (Dow), -1.8% (Nasdaq comp'), -1.6% (SPX, NYSE comp'), -0.9% (R2K), to -0.2% (Trans).

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes settled net lower for the week.

The Dow lead the way lower, whilst the Transports was resilient.

Multi-week price structure is a bear flag.

More broadly, all six US equity indexes are trading under their respective monthly 10MA.

Monthly momentum has turned negative in the Dow, having followed the Nasdaq comp' and R2K. The other three indexes should follow, whether before end month, or as of the March 1st open.

–

Looking ahead

It will be a short four day trading week, with Monday closed.

Earnings:

M - APA, WSM

T - HD, M, MDT, DNUT, CBRL, TDOC, SPCE, PANW, FANG, MOS, RIG, CZR

W - LOW, OSTK, TJX, PBR, BHC, FUBO, SKLZ, HTZ, CLOV, EBAY, LMND, BKNG

T - BABA, MRNA, NKLA, NCLH, W, SQ, COIN, ETSY, BYND, OPEN, ZS, RKT, OXY

F - FL, EOG, NOG, TREE, MGI, DSX

-

Econ-data/events

M - *CLOSED*

T - Case Shiller HPI, PMI manu' & serv', consumer con'

W -

T - Weekly jobs, GDP Q4 (print'2), new home sales, EIA Pet'

F - Pers' income/outlays, consumer sent', pending home sales

-

Final note

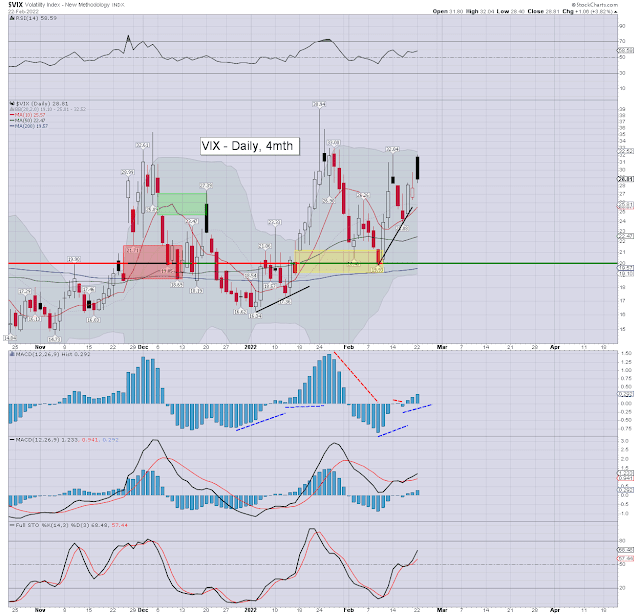

It was another week for the equity bears. Those trying to 'buy the floor' are getting regularly stopped out. I have to expect the January 24th lows to be taken out. Whether its before end month, or not until early March is of no real importance.

What is important are the bigger weekly and monthly charts, all of which are warning of increasing problems into the spring.

Some believe we've already had a massive drop, and for loss making garbage like DKNG, ROKU, PLTR, and HOOD, that is true. Yet the main market is only marginally below recent historic highs.

March offers far lower levels, and that won't require the Russians to make a move into the Ukraine. We've valid concerns of a slowing US/global economy, civil unrest, higher inflation, and monetary tightening.

If you're not hearing alarm bells, maybe you need to book an appt' with your doctor.

For more of the same...

For details and the latest

offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Tuesday Feb'22nd.