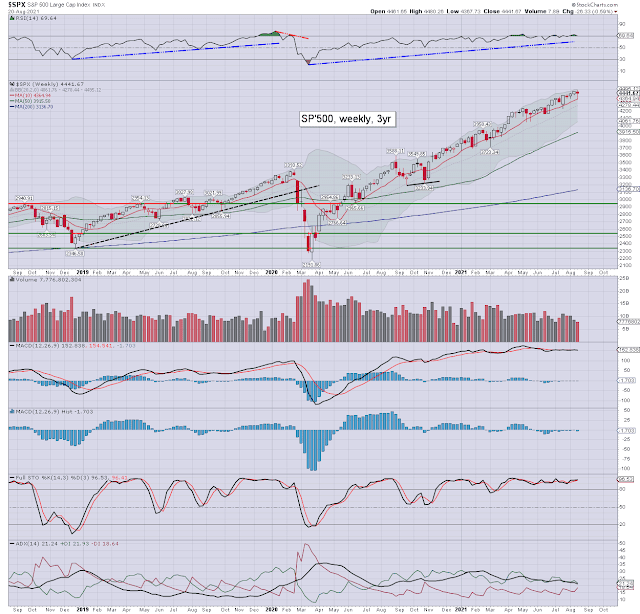

It was a bearish week for US equity indexes, with net weekly declines ranging from -2.5% (Trans, R2K), -2.1% (NYSE comp'), -1.1% (Dow), -0.7% (Nasdaq comp') to -0.6% (SPX).

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

NYSE comp'

R2K

Trans

–Summary

All six US equity indexes settled net lower for the week.

The Transports and R2K lead the way lower, with the SPX most resilient.

The SPX and Dow broke new historic highs.

More broadly, all six US equity indexes are holding above their respective monthly 10MA, and I thus see the m/t trend as bullish.

–

Looking ahead

We've a light sprinkling of earnings, but the market will be more focused on events at the hole. There is increasing chatter Powell will announce a plan for QE taper, although I'm still inclined to see that announced at the FOMC of Sept'22nd.

Earnings:

M - JD, PANW

T - BBY, MDT, JWN, URBN, TOL

W - DKS, SCVL, CRM, SNOW, ULTA, SPLK, BOX, WSM

T - ANF, DG, DLTR, COTY, BURL, MOMO, PTON, MRVL, WDAY, GPS, HPQ, DELL

F - BIG

-

Econ-data/events

M - PMI manu'/serv' existing home sales

T - New home sales

W - Durable goods orders, EIA Pet'

T - Weekly jobs, GDP Q2 (print'2)

*Economic Policy Symposium - Jackson Hole, Wyoming, Aug'26th, which continues into Sat' Aug'28th.

F - *Fed Chair Powell speech* , Pers' income/outlays, Intl' trade, consumer sent'.

-

Final note

Whilst indexes saw net weekly declines, that was after printing new historic highs (well, at least for the SPX and Dow). I remain aware of the ongoing background 'crash chatter', and I still see that as 'crazy talk' from the usual suspects.

The Labor day break is only two weeks away, and then summer will rapidly fade. We have one hell of an 'interesting' winter ahead. Some of you are aware of what might be ahead. To those who aren't, well... you're probably part of the problem anyway.

For more charts, and whatever else I want to post about - outside the

control of the corrupt and twisted mainstream media hacks, you know

where to find me in... the twilight zone.

For details and the latest offers, see: https://www.tradingsunset.com

Have a good weekend

*the next post on this page will likely appear 5pm EST on Monday.