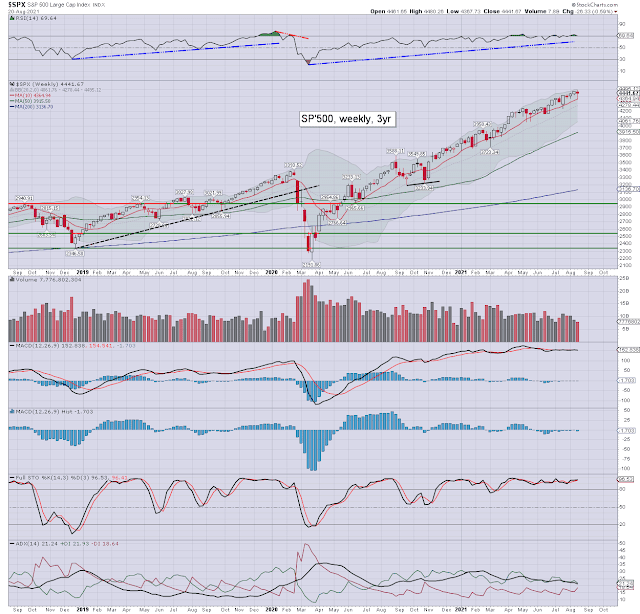

It was a bullish week for US equity indexes, with net weekly gains ranging from +5.0% (R2K), +2.8% (Nasdaq comp'), +2.4% (Trans), +2.0% (NYSE comp'), +1.5% (SPX), to +1.0% (Dow). Near term outlook offers upside into and beyond the Labor day holiday break.

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

NYSE comp'

R2K

Trans

–

Summary

All six US equity indexes settled net higher for the week.

The R2K lead the way higher, with the Dow lagging.

The SPX and Nasdaq comp' broke new historic highs.

More broadly, all six US equity indexes are holding above their respective monthly 10MA, and I thus see the m/t trend as bullish.

–

Looking ahead

Earnings:

M - ZM

T - FUTU, LI, NET, PVH, AMBA, CAL

W - CPB, CHWY, SWBI, OKTA, FIVE, VEEV, NTNX

T - SIG, LE, HRL, DOCU, AVGO, HPE

F -

-

Econ-data/events

M - Pending home sales

T - Case-Shiller HPI, Chicago PMI, consumer con'

W - ADP jobs, PMI/ISM manu', construction, vehicle sales, EIA Pet'

T - Weekly jobs, intl' trade, productivity/costs, factory orders

F - Monthly jobs, PMI/ISM serv'

*As Tuesday is the end of the month, I'd expect more dynamic price action on higher vol'.

**As Monday September 6th is CLOSED for Labor day, once Friday's econ data is out of the way, I'd expect considerable chop on light vol'.

Final note

It was a week for the equity bulls, not least with a couple of index historic highs. I remain aware of the background 'crash chatter', and I still see that as crazy talk from the usual suspects. Those lunatics would do well to go stare at the IWM/R2K chart for a good thirty minutes or so.

Indeed, two key price thresholds I would keep in mind are the 2340s for the R2K, and the $77s for WTIC. If either are printed it will bode powerfully bullish for the broader market, and for the record, I do expect to see both.

For more charts, and whatever else I want to post about - outside the

control of the corrupt and twisted mainstream media hacks, you know

where to find me in... the twilight zone.

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! For details and the latest

offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.