It was a bullish month for most world equity markets, with net monthly changes ranging from +8.9% (Germany), +6.6% (USA - Dow), +6.0% (Brazil), +4.6% (Russia), +2.8% (South Africa), +1.1% (Australia), +0.8% (India), +0.7% (Japan), -1.9% (China), to -2.1% (Hong Kong).

Lets take our regular look at ten of the world equity markets.

USA - Dow

The mighty Dow climbed for the ninth month of twelve, breaking a new historic high of 33259, and settling +2049pts (6.6%) to 32981. I would note the key 10MA at 28909, which as of the Apr'1st close, jumped/adjusted to 29643, and is climbing by around 700pts a month.

Next key Fibonacci is 34430, and then 42158. In the next correction, psy'30K will likely act as very strong support, before resuming upward. Such a correction clearly might not begin until the 34000s, if not the 35000s.

-

Germany – DAX

The German market powered upward, climbing for the ninth month of twelve, breaking a new historic high of 15029, settling +1222pts (8.9%) to 15008.

Japan – Nikkei

The Japanese market climbed for a fifth consecutive month, settling +212pts (0.7%) to 29178.

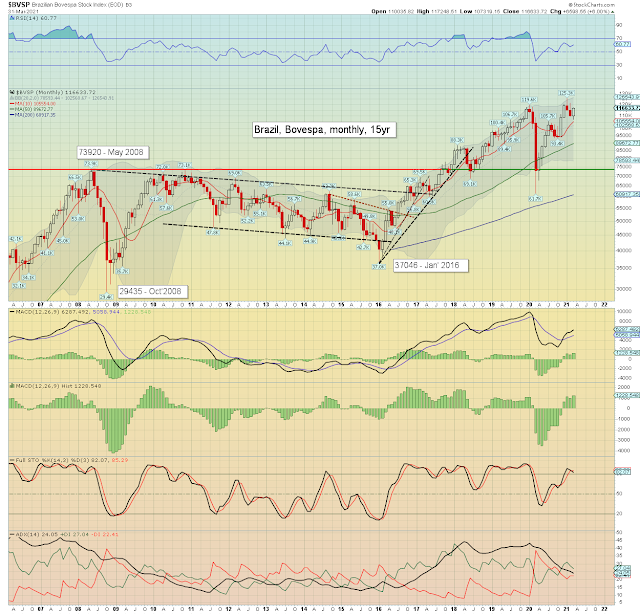

Brazil – Bovespa

The Brazilian market gained +6598pts (6.0%) to 116633. Multi-month price structure is a valid bull flag, offering new historic highs by mid year.

Russia - RTSI

Russian equities climbed for the fourth month of five, settling +65pts (4.6%) to 1477. Soft target is the Jan'2020 high of 1651.

India – SENSEX

The Indian market climbed for the ninth month of twelve, settling +409pts (0.8%) to 49509. The past three monthly candles are rather spiky, indicative of bullish exhaustion.

China – Shanghai comp'

The Chinese market struggled, settling -67pts (1.9%) to 3441. However, we have a subtle spike from the monthly 10MA, with price churning around key price threshold of the 3400s.

South Africa – Dow

The South African market powered upward for a fifth consecutive month, settling +54pts (2.8%) to 1973. Whilst the past few candles are rather spiky on the upper side, they still make for a series of higher highs and higher lows.

Hong Kong – Hang Seng

Hong Kong equities were the laggard, settling -601pts (2.1%) to 28378, although this still make for another monthly close above the 10MA. Recent news of changes to the rules for those wanting to run in elections certainly didn't help.

Australia – AORD

Australian equities climbed for the eleventh month of twelve, setting +76pts (1.1%) to 7017. Significant resistance within the 7000/7200s.

–

Summary

Eight world equity markets were net higher for March, with two net lower.

Germany and the USA lead the way higher, whilst China and Hong Kong lagged.

The USA and German markets broke new historic highs.

All ten world equity markets settled above their respective monthly 10MA, and I thus see the m/t trend in all ten as bullish.

Looking ahead

A very light week is ahead, with Q1 earnings formally starting Apr'14th with the financials.

Earnings:

M - DCT

T - PAYX, GBX

W - LW

T - STZ, WDFC, CAG, LEVI

F - JKS

-

Econ-data:

M - PMI/ISM serv', factory orders

T - JOLTS

W - Intl' trade, FOMC mins (2pm), Consumer credit (3pm)

T - Weekly jobs

F - PPI, wholesale invent'

--

Final note

March/Q1 was broadly bullish. April/Q2 has begun on a bullish note, with the USA (SPX) and the German (DAX) indexes breaking new historic highs.

The central banks are clearly part of it. Whilst there is an ongoing genuine economic recovery, its patchy, as some sectors will take years to adjust to the 'new normal'.

For now, the m/t trend for the collective of world equities is bullish. There is only one real threat to the economic recovery and equity ramp, but we can't talk about that here.

If you believe in liberty and something other than the mainstream narrative of lies and wilful delusion, then you know where to find me in... the twilight zone.

-

If you value my work, subscribe to my intraday service.

For details, and the latest offers: https://www.tradingsunset.com

Have a good Easter break

--

*the next post on this page will likely appear 5pm EST on Monday.