It was a positive week for most US equity indexes, with net weekly changes ranging from +3.0% (Transports), +1.6% (SPX), +1.4% (Dow), +0.8% (NYSE comp'), to -0.6% (Nasdaq comp).

Lets take our regular look at five of the main US indexes

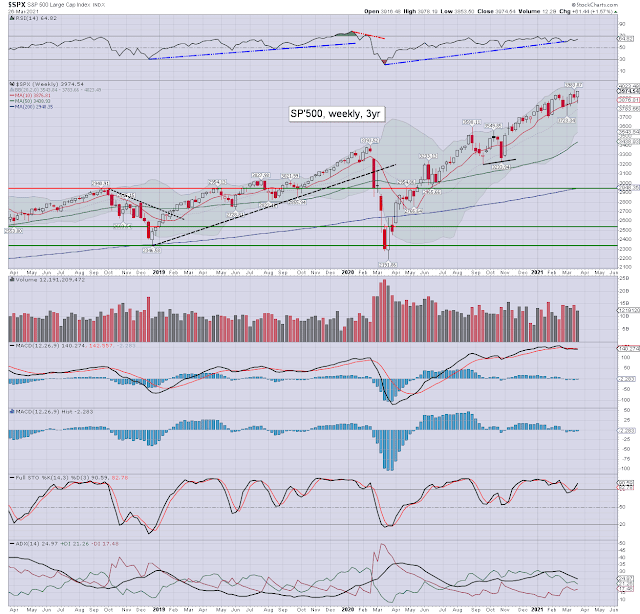

sp'500

Nasdaq comp'

Dow

NYSE comp'

Trans

–

Summary

Four indexes were net higher for the week, with one net lower.

The Transports lead the way higher, whilst the Nasdaq lagged.

The Transports broke a new historic high.

More broadly, all five US equity indexes are trading above their respective monthly 10MA, and I thus see the m/t trend as bullish.

–

Looking ahead

It will be a short four day trading week, as the market will be closed for Good Friday.

Earnings:

M -

T - BB, CHWY, LULU

W - WBA, MU, PVH

T - KMX

F -

-

Econ-data/events

M -

T - Case-Shiller HPI, consumer con'

W - ADP jobs, Chicago PMI, Pending home sales, EIA Pet'

T - Weekly jobs, PMI/ISM manu', construction, vehicle sales

F - *CLOSED* for 'Good Friday'. BLS monthly jobs

*As Wednesday is end month/Q1, I would expect more dynamic price action, on distinctly higher volume.

**As Friday Apr'2nd is closed, Thursday will lean to being a day of considerable price chop on light volume.

-

Final note

The second half of Thursday and especially Friday's closing hour, were further reminders of underlying main market strength. It remains pretty amusing to see how twitchy many become when the market isn't breaking a new historic high every... single ... day. Literally, even a sporadic 2-3 day cooling wave will see many start to openly question if an imminent 10-15% correction is underway.

Yours truly is well aware of the crash calling out there, and whilst the weekly and monthly charts are over-stretched, there is zero sign of a mid, never mind long term ceiling.

Mr Market will certainly want to wash out the short stops from around sp'4000, and draw in another tranche of bullish chasers. It should be clear, Monday will offer an opening gap straight into the 4000s.

What then? From 4K, its only another 25% to psy'5K. It can't be long until we start seeing some of the mainstream institutions start issuing 5K targets for late 2021 to mid 2022.

There are 'other issues' of course, but not here. If you are tired of the mainstream media hacks, and believe in freedom of speech, then you know where to find me... in the twilight zone.

--

If you value my work on Blogger, Twitter, and want more of the

same, subscribe to my intraday service! For details and the latest

offers, see:

https://www.tradingsunset.comHave

a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.