It was a bearish week for most US equity indexes, with net changes ranging from -1.0% (Trans), -0.5% (Nasdaq comp', Dow), -0.2% (SPX, R2K), to +0.2% (NYSE comp').

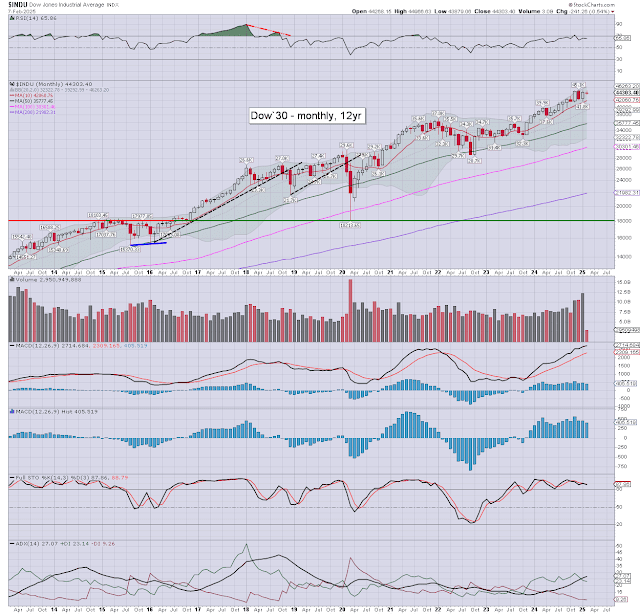

Lets take our regular look at six of the main US indexes (monthly candle charts).

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

Five US equity indexes were net lower for the week, with one net higher.

The Transports was sig' lower, whilst the NYSE comp' was a little higher.

All six indexes are trading above their respective 10MA.

Five indexes have positive monthly momentum, the exception being the Transports.

–

Looking ahead

Earnings:

M - $MCD $MNDY $ON $TSEM $INCY $ROK $GCMG $ALX $NSP $CNA $ALAB $FLNC $VRTX $ACLS $MEDP $AMKR $LSCC $MITK $INSP $ARWR

T - $SHOP $KO $HUM $BP $LDOS $AN $CRNT $SPGI $CG $MAR $SMCI $UPST $DASH $LYFT $FRSH $ET $GILD $CFLT $WELL $ZG

W - $VRT $CVS $GOLD $GNRC $BIIB $RDWR $KHC $PX $QSR $R $RDDT $APP $HOOD $BROS $ALB $KGC $TTD $CSCO $MGM $ASPN $AUR

T - $DDOG $CYBR $DE $CROX $DUK $PGY $SONY $PCG $HWM $GEHC $COIN $TWLO $DKNG $AMAT $ABNB $PANW $ROKU $WYNN $HL $RSG

F - $MRNA $ENB $AXL $AMCX $MGA $PQR $FTS $ACDVF $SXT $ESNT

-

Econ-data/events

M - -

T - NFIB optimism, 10am - Powell to the US Congress

W - CPI, 10am - Powell to the US Congress, US T-budget (2pm)

T - PPI, weekly jobs

F - Retail sales, indust' prod', Busin' invent', Import prices,

*with Monday 17th CLOSED for Presidents' Day, the preceding Friday 14th will likely be subdued on light vol'.

-

Final note

A bearish week, but nothing that merits any hysteria. Nor would another two percent lower to around SPX 5900 merit as anything of importance.

The only thing the bears can tout is the old leader - Transports, has seen monthly momentum turn fractionally negative, for the first time since July 2024.

I lean s/t bearish for next week, but again... the broader picture is unquestionably bullish.

Subscriptions: https://www.tradingsunset.com

Have

a good weekend... if you deserve it

--

*the next post on this page will likely appear 4.20pm EST on Monday.