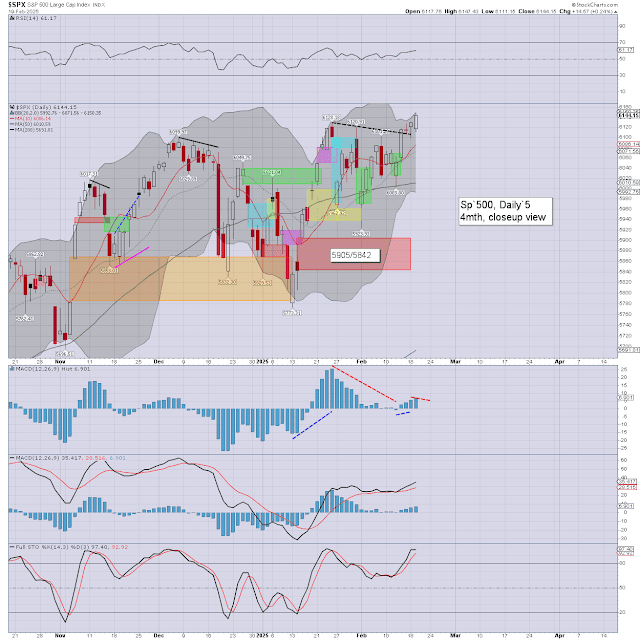

US equity indexes closed very significantly higher, SPX +92pts (1.6%) at 5954. Nasdaq comp' +1.6%. Dow +1.4%. The Transports settled +1.4%. R2K +0.9%

SPX - daily

VIX - daily

Summary

Equities opened a little mixed, with the SPX seeing moderate cooling, fully filling the downside gap to 5842. From there... choppy upside to 5903. The afternoon saw a swing lower to print a fractional lower low of 5938, but seeing a late afternoon ramp to settle very significantly higher at 5954.

Volatility was mixed, the VIX printing an early high of 22.06, cooling back to 19.92, a secondary spike to 22.40, and cooling back to settle -7.1% to 19.63.

-

|

| The sun sets on February |

|

| Early signs of spring |

|

| A fine evening |

–

Extra charts in AH (usually around 5pm EST) @

https://x.com/Trading_Sunset

Goodnight

from London

--

If you value my work on Blogger, X, and would like more of the same, then subscribe to my intraday service! For details and the latest offers, see: https://www.tradingsunset.com