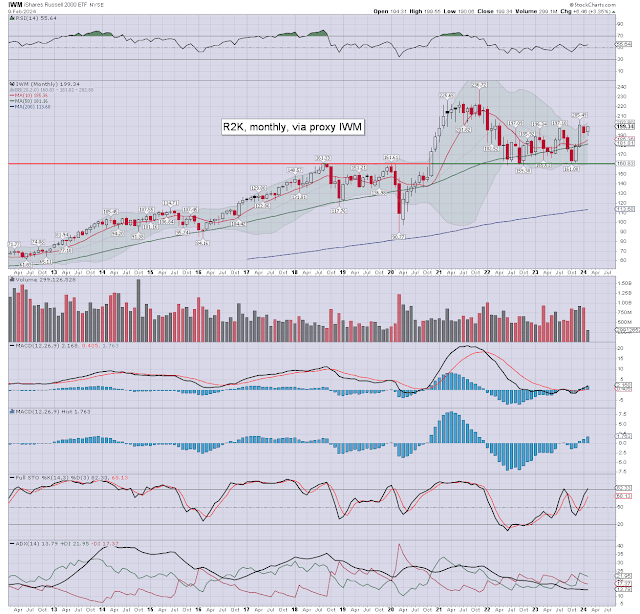

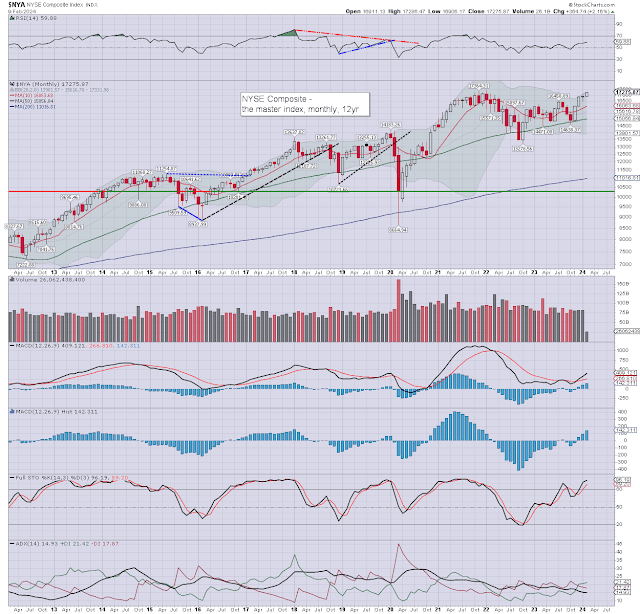

It was a bullish week for US equity indexes, with net weekly gains ranging from +2.6% (Trans), +2.5% (R2K), +2.3% (Nasdaq comp'), +1.4% (SPX), +1.0% (NYSE comp'), to +0.04% (Dow).

Lets take our regular look at six of the main US indexes (monthly candle charts)

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes were net higher for the week.

The Two leaders - Trans/R2K, lead the way up, whilst the Dow lagged.

The SPX broke a new hist' high.

More broadly, all six US equity indexes have increasingly positive monthly momentum, and are trading above their respective monthly 10MA.

–

Looking ahead

Earnings:

M - MDNY, TRMB, ALX, ANET, WM, CDNS, ZI, CAR, LSCC, MEDP, BHF, SBLK, TDC

T - SHOP, DDOG, KO, BIIB, MAR, HAS, MCO,QSR, INMD, AN, ABNB, UPST, HOOD, LYFT, MGM, AKAM, AIG, ZG, CART, EQT

W - GOLD, CME, KHC, SONG, PSN, GNRC, BXMT, WMB, SUN, MLM, ALB, TWLO, OXY, ET, CSCO, APP, FSLY, HUBS, UPWK, QS

T - CROX, DE, EPAM, YETI, PENN, QTLY, PBF, WEN, IDCC, AKKS, DKNG, COIN, ROKU, TTD, AMAT, DASH, AEM, TOST, OPEN, HASI

F - ABR, CNK, THS, LBRDA, POR, PPL, HR, AXL

-

Econ-data/events

M - US T-budget (2pm)

T - CPI

W - EIA Pet'

T - Weekly jobs, Empire state manu', Phil' Fed manu', retail sales, indust' prod', import prices, home builder conf'

F - PPI, housing starts, building permits, consumer sent', *OPEX*

As Friday will be OPEX, I'd expect considerable chop. Further, with the following Monday Feb'19th CLOSED, I'd expect vol' to be on the lighter side, with many quietly walking away into the long weekend.

-

If you value my work on Blogger, Twitter, and want more of the same, subscribe to my intraday service! For details and the latest offers, see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 4.20pm EST on Monday.