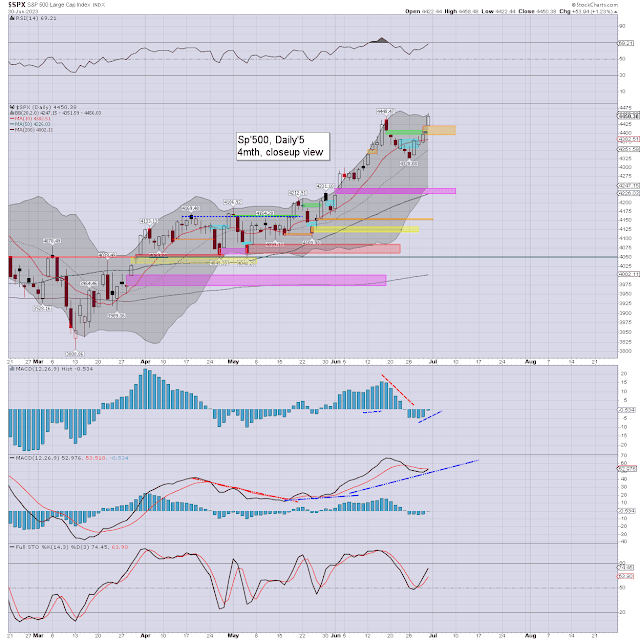

US equity indexes closed on a positive note, SPX +53pts (1.2%) at 4450. Nasdaq comp' +1.4%. Dow +0.8%. The Transports settled +0.1%. R2K +0.4%

SPX - daily

VIX - daily

Summary

US equities opened broadly higher, helped by positive European markets, and better than expected inflation (PCE) data. The SPX built significant gains into the late afternoon to print a new multi-month high of 4458, and settling at 4450.

SPX...

Net weekly gain +102pts (2.3%)

Net monthly gain +270pts (6.5%)

Net H1 gain +608pts (15.9%)

Volatility remained repressed, the VIX settling +0.4% to 13.59.

–

Extra charts in AH (usually around 5pm EST) @

https://twitter.com/Trading_Sunset

Goodnight

from London

--

Summer subscription offers, see: https://www.tradingsunset.com