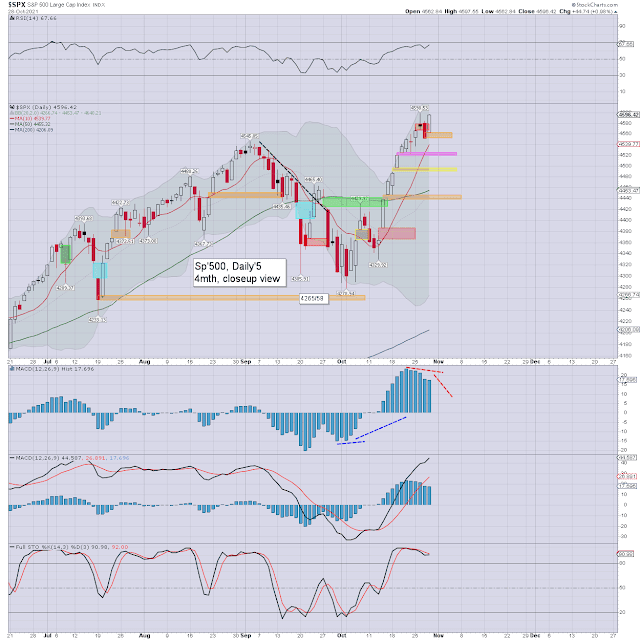

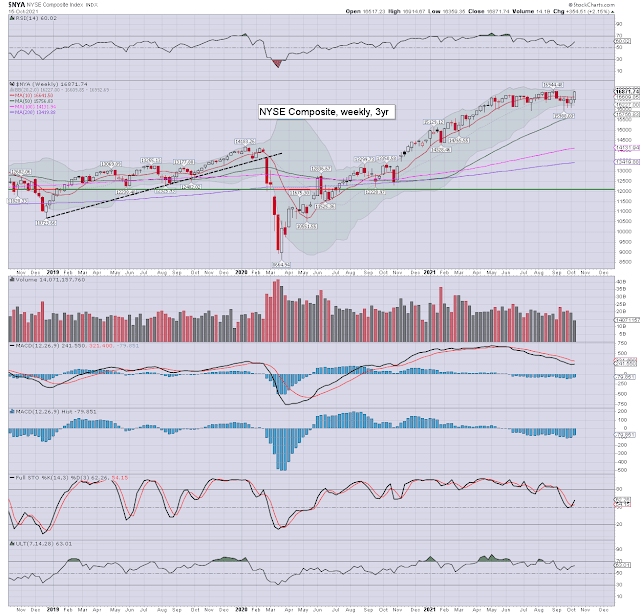

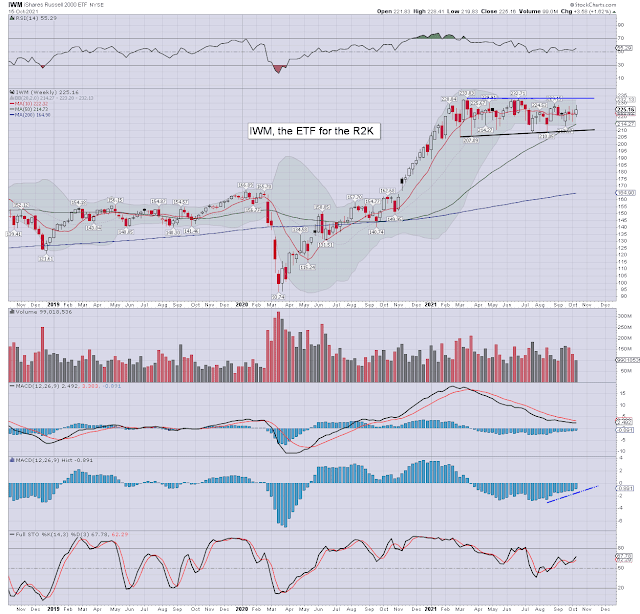

It was a very mixed month for world equity markets, with net monthly changes ranging from +5.8% (USA), +3.7% (Russia), +3.3% (Hong Kong), +2.8% (Germany), +0.9% (South Africa), +0.3% (India), +0.1% (Australia), -0.6% (China), -1.9% (Japan), to -6.7% (Brazil).

Lets take our regular look at ten of the world equity markets.

USA - Dow

Germany – DAX

Japan – Nikkei

Brazil – Bovespa

Russia - RTSI

India – SENSEX

China – Shanghai comp'

South Africa – Dow

Hong Kong – Hang Seng

Australia – AORD

–Summary

Seven world equity markets settled net higher, with three net lower.

The USA lead the way upward, with the Brazilian market powerfully lower.

The USA and Indian markets broke new historic highs.

The USA, German, Japanese, Russian, Indian, Chinese, and Australian markets are above their respective monthly 10MA, with the Brazilian, South African, and Hong Kong markets below.

-

Looking ahead

A very busy week is ahead, with another truckload of earnings, but also an FOMC, that will see a plan for QE taper announced. The latest jobs data (especially Friday) will also have a strong bearing on how the market trades in early November.

*UK/European clocks move back one hour at 2am, Oct'31st, with the USA following Nov'7th.

Earnings:

M - ON, PCG, TRVG, FANG, RIG, CLX, NXPI, CHGG, CAR, MOS

T - PFE, CRSR, BP, UAA, GNRC, COP, MPC, EL, RACE, ATVI, DVN, Z, TMUS, AMGN, XPO

W - CVS, NCLH, CPRI, DISCA, ROKU, QCOM, SKLZ, MRO, FSLY, ET, ETSY, SAND

T - MRNA, PENN, VIAC, REGN, GOLD, NKLA, SQ, PINS, UBER, ABNB, PTON, NET, FTNT, OXY,

F - DKNG, COIN, CGC,

-

Econ-data:

M - PMI/ISM manu', construction

T -

W - ADP jobs, PMI/ISM serv', Durable goods orders, Factory orders,

*FOMC announcement (2pm). Press conf' (2.30pm). QE taper can be expected to be announced. Its likely that interest rate hike expectations will be brought forward.

T - Weekly jobs, intl' trade, productivity/costs

F - Monthly jobs, consumer credit

--

|

| The sun has set on British Summer Time |

Final note

I will merely ask this... do you remember all those maniacs calling for a crash across October? Where are they now? Can you guess what they'll be calling for this November?

Eventually... yes, we're going to see another major collapse, but that could be a long.... long ways away. In the meantime, I remain focused on commodities, especially the energy sector, which still seems the most straight forward trade/investment.

For more

charts, and whatever else I want to post about, you know

where to find me in... the twilight zone.

For details, and the latest offers: https://www.tradingsunset.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.