US equity indexes mostly closed a little mixed, SPX +6pts (0.2%) at 3701. Nasdaq comp' +0.5%. Dow -0.1%. The Transports settled +0.1%.

sp'daily5

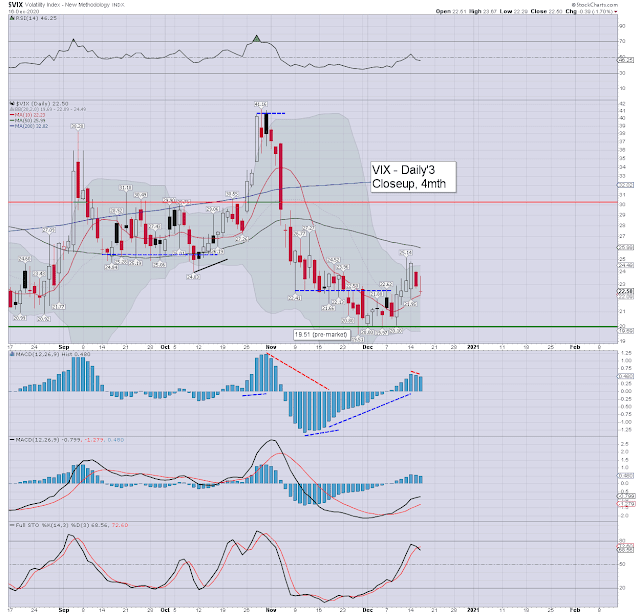

VIX'daily3

Summary

US equities opened in minor chop mode, and naturally remained in a holding pattern into the 2pm press release from Print Central.

Equities saw some moderate swings with the 2pm press release, with the SPX pushing to 3711 in the closing hour, just one point shy of last week's historic high. There was a subtle degree of rats quietly exiting into the close.

Most notable, was the Fed's outlook that it will maintain ZIRP until at least the end of 2023.... a full THREE years. Its pretty incredible, and for those with significant cash savings (they do still exist)... its a devastating policy statement.

Volatility was ground lower, the VIX settling -1.7% to 22.50. The s/t cyclical setup favours the equity bears... for what is a Thursday. Friday is OPEX, and that will inherently bode for broad chop.

*There are just ten trading days left of 2020.

–

Extra charts in AH (usually around 5pm EST) @

https://twitter.com/Trading_Sunset

Goodnight

from London

--

If you value my work on Blogger, Twitter, and want more of the same, then subscribe to my intraday service! For details and the latest offers, see: https://www.tradingsunset.com