US equities are holding moderate gains, and regardless of the exact close, with a new set of index historic highs, its been just another day for the equity bulls. VIX has been ground to the 21s, and all the bulls are missing is a break under the key 20 threshold.

sp'60min

VIX'60min

Summary

Whilst s/t momentum is due to turn negative early Friday cooling, at best, the bears could expect weak leaning chop for what will be OPEX. More broadly, Tom Lee's 4300s are clearly viable by late spring/mid 2021.

--

notable stock: FDX

FedEx has earnings in AH, and those should come in superb, as the restrictions remain a positive for the delivery companies. Post earnings implications for sister/rival UPS... on Friday.

--

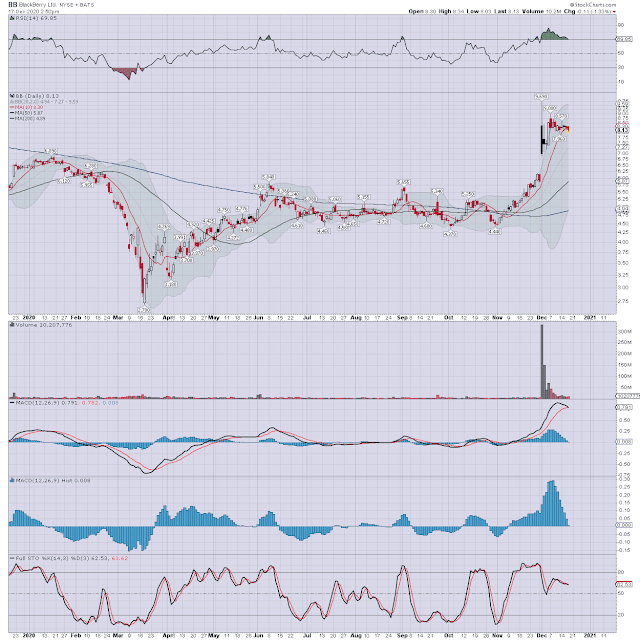

notable stock: BB

Blackberry has earnings in AH. Its not one I follow, and its a wonder the company is still operating. The cyclical setup isn't pretty, with momentum set to turn negative.

--

notable stock: M

Macy's due to settle sig' higher. The company is arguably still fighting for survival on a mid/long term basis. I don't like it, and for retail, would favour HD or TGT.

UOA: >29000 Dec'31st $11 CALLS.

--

notable stock: TSLA

The market was open, so why wouldn't Tesla be up? I'm not sure if anyone out there is already targeting giant psy' $1K again, and then how long until another stock split?

back at the close...