It was a very mixed month for world equity markets, with net monthly changes ranging from +15.9% (Argentina), +6.3% (Brazil), +2.1% (Germany), +1.8% (USA), +1.5% (South Africa), +0.8% (India), -0.04% (Australia), -1.2% (Japan), -3.3% (China), to -10.0% (Russia).

Lets take our regular look at ten of the world equity markets.

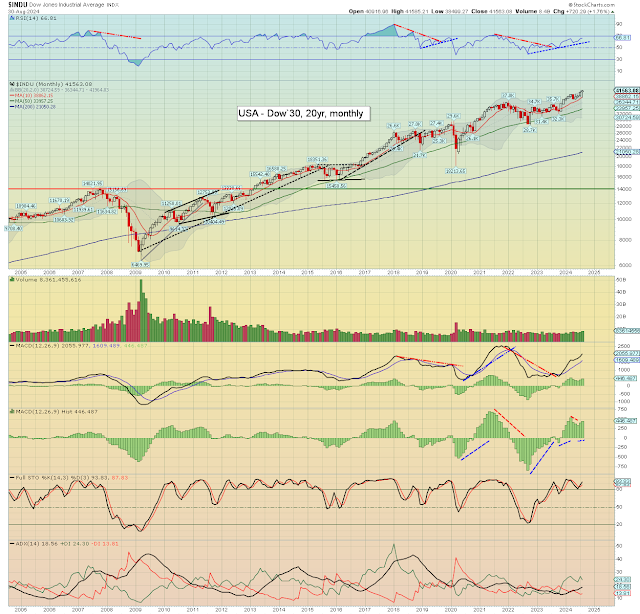

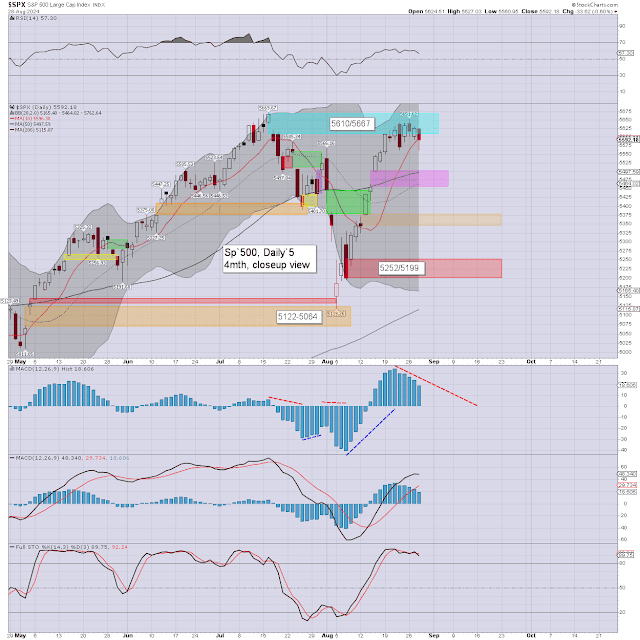

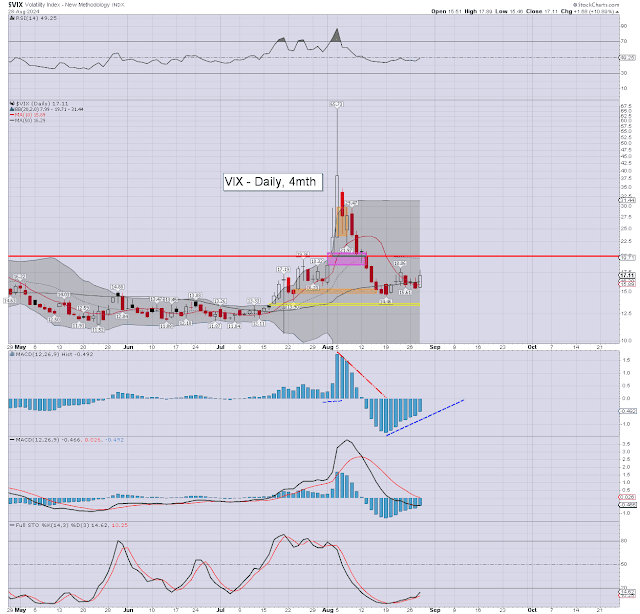

USA - Dow

Germany – DAX

Japan – Nikkei

Brazil – Bovespa

Russia - MOEX

India – SENSEX

China – Shanghai comp'

South Africa – Dow

Argentina - MerVal

Australia – AORD

–

Summary

Six world equity markets were net higher for August, with four net lower.

Argentina lead the way up, whilst Russia was very powerfully lower.

New historic highs: USA, Germany, Brazil, India, South Africa, Argentina, Australia

Eight markets have positive monthly momentum, and are trading above their respective monthly 10MA. The two exceptions being Russia and China.

-

Looking ahead

It will be a short four day trading week, with Monday CLOSED for Labor day.

Earnings:

M - *CLOSED*

T - $MOMO $ZS $GTLB $ASAN $HQY $SPWH $OS $PD

W - $DKS $DLTR $HRL $CIEN $CNM $CRMT $CURV $JILL $KNOP $DAKT $AI $HPE $CHPT $CASY $CRDO $CXM $CPRT $AVAV $VRNT $BBCP

T - $NIO $FCEL $TTC $SAIC $LE $GILL $KFY $MEI $MOV $SCVL $AVGO $PATH $IOT $DOCU $PL $BRZE $NX $ZUMZ $SMAR $TLYS

F - $BIG $ABM $BRC $GCO $DODO

-

Econ-data/events:

M - *CLOSED*

T - PMI/ISM manu', construction

W - Intl' trade, JOLTS, factory orders, Fed beige book (2pm)

T - ADP jobs, Weekly jobs, productivity, PMI/ISM serv'

F - Monthly jobs,

--

Final note

Considering the seven historic highs, it should be seen as a net bullish month for world equities.

September through October will typically favour the equity bears, not least ahead of an election. I'd accept, the latter is an issue solely for the USA. In any case... we'll likely need a fair amount of popcorn and drinks into November 5th.

For more of the same, subscribe to my intraday service.

For details, and the latest offers: https://www.tradingsunset.com

Enjoy the holiday weekend

--

*the next post on this page will likely appear 4.20pm EDT on Tuesday, September 3rd.