It was a mixed week for US equity indexes, with net weekly changes ranging from +1.4% (Nasdaq comp'), +0.03% (SPX), -1.3% (R2K), -1.5% (NYSE comp'), -2.3% (Dow), to -2.7% (Trans).

Lets take our regular look at six of the main US indexes

sp'500

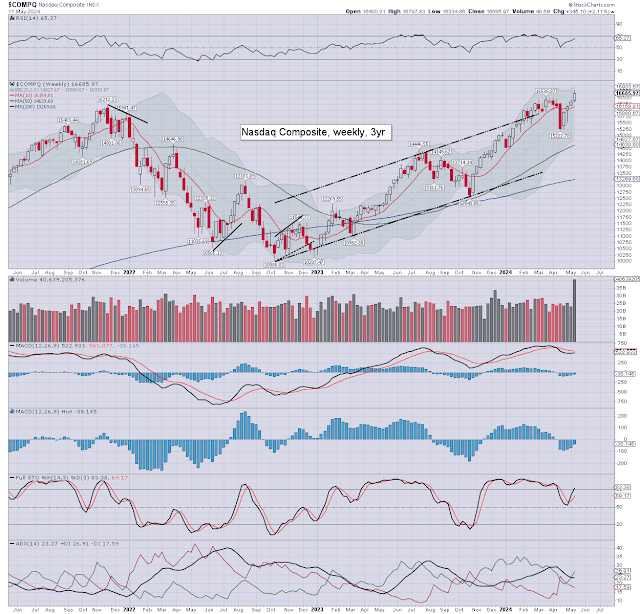

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

Two US indexes were net higher for the week, with four net lower.

The Transports lead the way down, whilst the Nasdaq was most resilient.

The SPX, Nasdaq, Dow, and NYSE comp' broke new historic highs.

–

Looking ahead

It will be a short four day trading week, with Monday CLOSED for Memorial Day.

*As of Tuesday May 28th, the trade settlement period will change from t+2 to t+1

Earnings:

M - *CLOSED*

T - $BNS $FUTU $DSX $MOMO $CAVA $APPS $BOX $HEI $YY $ODMA $CSAN

W - $ANF $CHWY $DKS $AAP $NAT $BMO $CRM $AI $PATH $OKTA $NTNX $PSTG $HPQ $A $AEO $AMSC

T - $CGC $KSS $FL $DG $BBY $HRL $BURL $BIRK $BBW $COST $DELL $ZS $MRVL $MDB $ULTA $S $NTAP $VEEV $ESTC

F - $DOOO $GCO

-

Econ-data/events

M - *CLOSED*

T - Consumer conf'

W - Fed Beige book (2pm)

T - GDP Q1 (Print'2), Weekly jobs, intl' trade, wholesale invent', pending home sales, EIA Pet'

F - Pers' income/outlays, PCE, Chicago PMI

With Friday being end month, I'd expect more dynamic price action on higher' vol.

--

Final note

A quartet of index new historic highs made it a net bullish week. Most other world markets are similarly at/near historic highs. You can slate valuations (not least for tech stocks), but I'd throw back at you 'Ohh, so you'd rather have a Govt' bond instead?'

For the few awake, it should be clear matters on planet Krazy continue to deteriorate. The two significant conflicts of Ukraine/Russia, and Israel/Palestine shouldn't be overlooked. Do you think either we be resolved any time soon, never mind the threat of escalation?

There is also the matter of the US election. Mr Market can be expected to be increasingly shaky, especially once we're on the flip side of the Labor day (Sept'2nd) holiday.

The failed state of the UK also has an election... July 4th, but 'freedom and independence' is the last thing on the agenda of the corrupt political class. Whether its red team or blue team.. its the same broad anti-humanity policies. The UK economy itself has been flat-lining since mid 2022. Two years, with zero reason to expect anything different into the 2030s.

Solar flares, nuclear vapourisation, avian flu, or round-ups of the resistance into secret re-education camps, things will get relentlessly worse with each day.

As a mere spectator to such a sick society/species, it makes for one hell of a show though. I'm going to need to order more popcorn and soda, as this summer is going to be... hot.

Whilst the UK doesn't have a Memorial day, on Monday I will remember the millions - not least my grandfather, who died fighting against the sub-human NAZI filth of Germany and Imperial Japan.

>>> https://www.tradingsunset.com

Have a good holiday weekend... if you deserve it.

*the next post on this page will likely appear 4.20pm EDT on Tuesday, May 28th