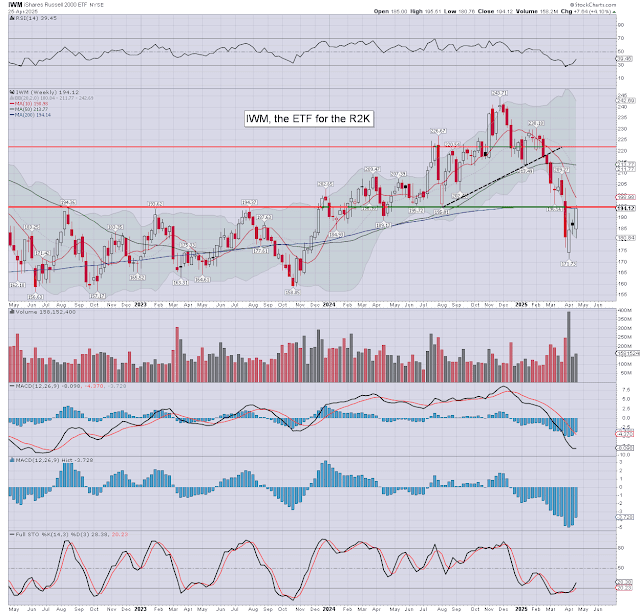

It was a bullish week for US equity indexes, with net weekly gains ranging from +6.7% (Nasdaq comp'), +4.6% (SPX), +4.1% (R2K), +2.9% (NYSE comp'), +2.5% (Dow), to +0.4% (Trans).

Lets take our regular look at six of the main US indexes

sp'500

Nasdaq comp'

Dow

R2K

NYSE comp'

Trans

–

Summary

All six US equity indexes were net higher for the week.

The Nasdaq was very powerfully higher, whilst the Transports was the laggard.

The SPX, Nasdaq, R2K, and NYSE comp', had bullish engulfing weekly candles, and are very suggestive of a higher high next week.

–

Looking ahead

An exceptionally busy week is ahead, with a truck load of big name earnings, and the first print of Q1 GDP. No doubt, there will be further tariff related news headlines.

Earnings

M - $DPZ $MGM $CX $WM $NXPI $FFIV $TER $NUE $RIG $WELL $CDNS $ABCB $AMKR

T - $KO $SOFI $PYPL $UPS $JBLU $PFE $RCL $SPOT $FOUR $MO $V $SBUX $SNAP $FSLR $PPG $BKNG $QRVO $OKE $ACGL $TTI

W - $CAT $HUM $VMC $WDC $GNRC $IP $WGS $ADP $HES $GEHC $MSFT $META $QCOM $HOOD $ALB $GRBK $PPC $NLY $CP $PRU

T - $MCD $SHAK $LLY $RBLX $CVS $MA $SIRI $BAX $PWR $BLDR $AMZN $AAPL $RIOT $ABNB $RDDT $BBAI $TEAM $FIVN $AIG $AJG

F - $XOM $CVX $AES $FUBO $BEP $MGA $APO $CE $WEN $FET

-

Econ-data/events

M - -

T - Intl' trade, retail & wholesale inventories, Case-Shiller HPI, consumer conf', JOLTS

W - Q1 GDP (print'1), ADP jobs, Pers' income/spending, PCE, Chicago PMI, pending home sales

T - Weekly jobs, PMI & ISM manu', construction, vehicle sales

F - Monthly jobs, factory orders

*As Wednesday is end month, I'd expect more dynamic price action on higher vol'. In theory... leaning to the downside.

-

Final note

If anything, its bemusing that some don't accept 4835 as a key low. Somewhat less bizarre is seeing a number touting a straight push to new historic highs. On what excuse do they see that happening? I see a fair number of upside targets, but no one wants to give a reason for such upside.

Whilst yours truly is still lacking a DeLorean, the style of price action we've seen since the Feb' high of 6147 is clear. We're s/t bullish into the May 7th FOMC. The SPX 5700s and VIX 20s is the easy call. The tough call is whether we then stall... and eventually break <4835, or broadly climb across the summer.

Regular readers should be well aware of where I see us headed. For now, I'll merely note... m/t bearish unless >5850 (to be decisive).

Just be sure to have enough popcorn for the 'big show', which is only going to become more dramatic, but then... who doesn't love some drama?

Subscription offers,

see: https://www.tradingsunset.com

Have

a good weekend

--

*the next post on this page will likely appear 4.20pm EST on

Monday.