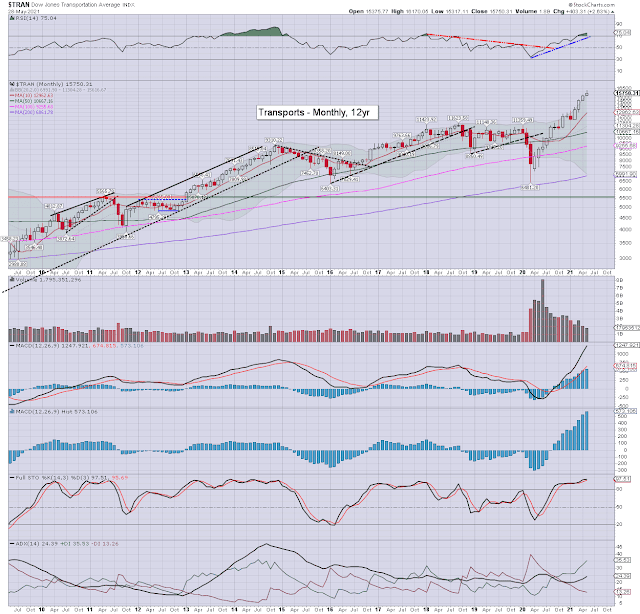

It was a bullish month for most US equity indexes, with net monthly changes ranging from +2.6% (Transports), +2.1% (NYSE comp'), +1.9% (Dow), +0.5% (SPX), to -1.5% (Nasdaq comp'). Near term outlook threatens some cooling into mid June.

Lets take our regular look at five of the main US indexes

sp'500

Nasdaq comp'

Dow

NYSE comp'

Trans

–

Summary

Four US equity indexes saw net monthly gains, whilst one settled lower.

The Transports lead the way higher, whilst the Nasdaq comp' was sig' lower.

The SPX, Dow, NYSE comp', and Transports broke new historic highs.

All five US equity indexes settled May above their respective monthly 10MA, and I thus see the m/t trend as bullish.

-

Looking ahead

It will be a short four day trading week, with Monday CLOSED for Memorial day.

Earnings:

M - *CLOSED*

T - CGC, ZM, HPE, AMBA

W - LE, SPLK, PVH

T - DLTH, CRWD, DOCU, AVGO, LULU, FIVE, WORK

F - -

-

Econ-Data:

M - *CLOSED*

T - PMI/ISM manu', construction

W - Vehicle sales, Fed Beige book (2pm)

T - ADP jobs, weekly jobs, EIA Pet', productivity/costs, PMI/ISM Serv'

F - Monthly jobs, factory orders

--

|

| Day two of summer warmth |

Final note

With the SPX breaking a new hist' high of 4238, it was just another month for the equity bulls. There is ongoing background crash calling, but its from the usual suspects, and its to be dismissed as just 'crazy talk'.

A washout to around sp'4000 wouldn't be a surprise by mid June, but from there... renewed upside into Q2 earnings in July.

Yours truly has bigger priorities right now than Twitter and my public

Blogger page. However, that doesn’t mean I’m not providing intraday

coverage to my

subscribers. For charts, and whatever else I want to post about…. you

know where to find me in... the twilight zone.

If you value my work, subscribe to my intraday service.

For

details, and the latest offers: https://www.tradingsunset.com

Enjoy the long weekend

--

*the next post on this page might appear by 5pm EST, Tuesday June 1st.